Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase coverage from the extended warranty providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of extended warranty providers. See our Privacy Policy to learn more.

In this car warranty review, CarShield earned 4.5 score of out of 5.0 stars based on its coverage, cost, customer service, and industry standing.

Crash Course:

- Most CarShield warranty plans cost between $99 and $129 per month.

- CarShield offers six levels of coverage to choose from.

- Each CarShield plan comes with benefits like trip interruption coverage, rental car reimbursement, and roadside assistance.

CarShield is one of the most prominent names in the car warranty industry. Based on the company’s overall score of 4.5 out of 5.0 stars in our 2024 extended warranty study, its reputation appears to be well-earned. But that doesn’t necessarily mean that CarShield is the best choice for every driver.

Our experts took a detailed look at the coverage options, benefits, and rates CarShield offers. We also studied dozens of customer reviews to get an accurate assessment of what the company offers and the quality of its services. You’ll find what we learned in the article below, along with a few other highly rated extended car warranty providers to consider.

CarShield Review

In our most recent car warranty study, we gave CarShield 4.5 out of 5.0 stars. The overall score is based on factors such as industry standing, coverage, customer service, and affordability.

That rating was one of the highest of any provider in our industrywide study, putting CarShield among the top options overall. The company performed especially well when it comes to affordable coverage and benefits.

Expand the section below to see a table with a breakdown of how CarShield performed in each category.

What We Like About CarShield

CarShield performs well overall, but there are a few things our editorial team especially likes about the provider:

- Coverage for high-mileage vehicles: CarShield offers plans for cars with up to 300,000 miles, well beyond what many providers are willing to cover.

- Included benefits: CarShield plans come with roadside assistance as a free perk. This often costs extra and can offer valuable peace of mind.

- Affordable coverage: CarShield earned the title for Affordable Monthly Payments in our 2024 study due to its competitive rates. The company will likely be one of the cheaper options for many drivers.

CarShield Pros and Cons

| CarShield Pros | CarShield Cons |

|---|---|

| Makes direct payments to repair shops | Not all plans come with rental car reimbursement |

| Coverage can be used at any ASE-certified mechanic | Relatively high number of negative reviews |

| High maximum mileage limit of 300,000 miles |

Is CarShield Worth It?

Whether a CarShield plan is worth it for you depends on factors like your vehicle’s reliability and your financial situation. If you want to protect your car for the long run or crave peace of mind about costly repairs that otherwise would’ve been out of pocket, CarShield could be worth it.

CarShield offers a useful range of plans and very reasonably priced coverage for such a reputable extended car warranty company. The provider’s prices make it an especially attractive option if you’re on a tight budget and in need of a used car warranty.

CarShield Highlights

Founded: 2005

Headquarters: St. Peters, Missouri

Coverage levels: 6

CarShield is one of the country’s most popular independent warranty providers, offering affordable ratees, flexible protection plans, and a range of deductibles. For a low, fixed price with month-to-month payments that are an industry rarity, CarShield warranties go beyond a factory warranty in covering expenses incurred as a result of mechanical breakdown.

CarShield is technically a vehicle service contract broker, meaning that it offers protection plans administered by other companies such as American Auto Shield. This setup gives drivers a wider variety of coverage options and price points. You can even find coverage for all-terrain vehicles (ATVs), motorcycles, and other alternative vehicles.

CarShield has been featured on ESPN, CNN, HGTV, and TBS and has a number of celebrity endorsements, including one from rapper and actor Ice-T.

CarShield Customer Reviews and Ratings

CarShield customer reviews vary greatly, though most drivers report positive experiences. However, reviews for CarShield customer service representatives are mixed.

CarShield Ratings

The company has an average score of 4.2 out of 5.0 stars from more than 1,200 Google reviews. CarShield customers award this company a 4.0-star rating out of 5.0 on Trustpilot, where 76% of over 39,000 customer reviews are positive. CarShield reviews are much lower on the Better Business Bureau (BBB), where it only has a 1.3-star rating out of 5.0 from over 2,200 reviewers.

Despite many positive reviews, the BBB offers CarShield a D and used to give it an F rating. The organization indicates a pattern of complaints against CarShield involving pushy or misleading sales and advertising, difficulty canceling policies, and issues with representatives. CarShield also lacks accreditation from the BBB.

Expand the section below to read real CarShield reviews from customers online.

CarShield Cost

Our research team reached out to CarShield for cost estimates on a few vehicles. Based on the quotes we received, we found that most CarShield plans cost between $99.99 and $129.99 per month.

CarShield is considered an affordable provider compared to other extended car warranty companies. Our research team conducted a warranty survey polling 1,000 drivers about what they spent on coverage. A majority said they paid $1,600 to $3,200 for their vehicle service contracts.

CarShield Warranty Quotes

The table below shows some of the quotes we received from CarShield.

| Vehicle Type | CarShield Warranty | Term Length | Monthly Payment | Deductible |

|---|---|---|---|---|

| 2018 Toyota Camry | Diamond plan | 5 years/100,000 miles | $99.99 monthly | $100 |

| 2013 Honda Accord | Gold plan | Unlimited | $119.99 monthly | $100 |

| 2016 Chevrolet Silverado | Diamond plan | Unlimited | $199.99 monthly | $100 |

| 2017 Honda CR-V | Platinum plan | Unlimited | $119.99 monthly | $100 |

With CarShield, drivers can choose from multiple deductibles that start at $0. The company specializes in monthly payment plans, so motorists don’t have to worry about being locked into long-term contracts.

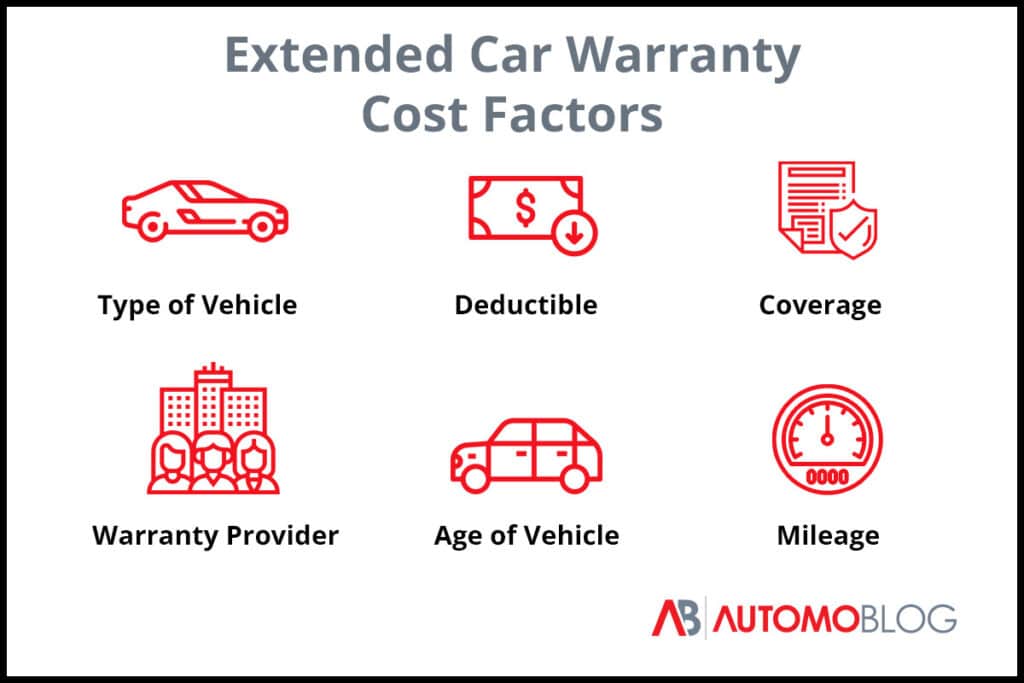

CarShield Warranty Cost Factors

Extended car warranty costs with CarShield will vary based on your situation. There are a few factors that go into the cost of your coverage, including the details of your car and the plan you choose. Your particular contract may fall outside of the price range shown above.

Some of the main factors that influence the cost of a CarShield extended warranty include:

- Type of vehicle: The make and model of your vehicle will affect how much you pay for a car warranty. Typically, luxury and vintage vehicles will cost more to cover.

- Vehicle age and mileage: Usually, older vehicles and models with higher mileage will cost more to cover under a warranty. That’s because they’re at a higher risk of breakdowns.

- Level of coverage: Most companies offer multiple warranty coverage levels, and the higher range of parts covered will come with a higher cost.

- Deductible: Similar to car insurance companies, CarShield lets you choose your deductible. The lower you set your deductible, the more you’re likely to pay for warranty coverage.

- Warranty provider: Companies charge different rates, even for the same level of coverage on an equal vehicle. This is why it’s important to get a few free quotes to compare.

CarShield Coverage

What an extended car warranty covers depends on the plan you choose. CarShield offers six plans that range from powertrain-only coverage to exclusionary coverage similar to a factory warranty.

CarShield Extended Warranty Plans

In the table in the collapsed section below, you’ll find summaries of each of the coverage plans CarShield offers. Expand the section with the arrow to read them.

CarShield Additional Benefits

In many CarShield reviews, customers touted the company’s benefits. With CarShield warranty contracts, drivers receive the following perks:

- 24-hour roadside assistance with services such as fuel delivery

- Courtesy towing for breakdowns (not included with all plans)

- Rental car reimbursement (not included with all plans)

CarShield Warranty Exclusions

CarShield does not cover:

- Parts that have been modified or altered

- Regular maintenance items such as windshield wiper blade replacements and oil changes

- Wear and tear components such as brake pads and air filters

- Damage caused by acts of nature, collision, vandalism, or lack of proper maintenance

- Auto repairs that have been made without pre-authorization from a CarShield claims representative

Even the most comprehensive extended auto warranties have their limits. The exclusions in CarShield plans are common among almost every extended warranty provider on the market.

CarShield Mobile App

The CarShield mobile app, available for Android and iOS, allows policyholders to view details of their contracts on mobile devices. On the app, you can quickly find information on warranty claims, customer service, and roadside assistance.

CarShield Mobile has overall positive ratings from users online. The app has an average rating of 3.5 out of 5.0 stars on both the Apple Store and on Google Play.

How Does CarShield Work?

CarShield vehicle service contracts allow you to pay ahead of time, either in the form of an upfront payment or on a monthly basis, to cover the cost of mechanical breakdown repairs. When you need repairs, CarShield will pay for the work minus your deductible as long as the affected components are covered and your account is in good standing.

CarShield Quote Process

According to many of the CarShield reviews we saw, the company offers an easy process for purchasing an extended warranty. You can get a quote by inputting your information on the company’s website.

It may seem more convenient to get a quote over the phone, but this isn’t always the case. When our team called CarShield to inquire about a quote, we were put on hold multiple times for a total of 15 minutes.

If you’re interested in purchasing an extended warranty, we recommend getting a quote from CarShield to see if the extended warranty company is a good option for you. CarShield reviews indicate that customer service representatives are generally friendly and will provide you with a reasonably priced quote. You can also receive a free quote online at CarShield.com.

How To Use a CarShield Warranty

It’s easy to find mechanics who accept CarShield coverage. If you have a vehicle service contract through the company, covered repairs can be made at any dealership or repair facility certified by the National Institute for Automotive Service Excellence (ASE®). Here’s how it works:

- Make sure repairs are covered: Check your CarShield contract to ensure that the repairs you need are actually covered.

- Take your vehicle in: Have repairs done at the certified repair center or dealership of your choice. Be sure to mention that you have and will be using extended warranty coverage.

- Pay your deductible: To have repair work done, you’ll need to pay your deductible amount.

- Let CarShield pay the rest: A CarShield representative will work directly with the facility to pay the remainder of your repair costs.

More than a few of the CarShield reviews we read mentioned a smooth, easy repair and claims process. This means that you can reasonably expect the same from the provider.

CarShield Deductible Options

CarShield allows you to choose your deductible in most cases. The company offers $0, $50, $100, and $200 deductibles. In general, a $100 deductible is considered the standard option.

CarShield Waiting Period

Like most vehicle service contract providers, CarShield plans come with a mandatory waiting period on covered repairs of 20 days and 500 miles. This helps the provider to ensure that warranty coverage won’t be used on preexisting conditions.

CarShield Warranty Transfer Policy

CarShield warranties are transferable. The company allows you to transfer your warranty to another owner if you sell your vehicle for a $50 fee. This can be a great add-on to make your car more valuable should you decide to sell it while your warranty is still active.

However, coverage follows the vehicle. You can’t transfer the warranty to another vehicle you own or buy. Instead, you’ll have to sign up for a new policy.

How To Cancel CarShield

You can cancel a CarShield policy at any time. However, to cancel your contract you’ll need to contact customer support directly and submit a policy cancellation notice.

If you cancel within the first 30 days of your policy, you’ll get a full refund. After 30 days, you’ll likely get a prorated refund for the amount of time left on your policy.

CarShield vs. Manufacturer Extended Warranty

Many automotive manufacturers offer their own vehicle service contracts. In terms of price and coverage, these tend to be somewhat competitive with CarShield and other third-party warranty companies.

However, there are some key differences. Manufacturer warranties typically require you to have auto repairs done at the dealership while third-party warranties allow for work at any ASE-certified repair facility.

In addition, third-party warranty companies typically offer more choices in terms of plans and coverage than automakers. Many manufacturer plans only offer one level of coverage, which may explain why CarShield reviews often praise the company’s multiple options.

CarShield Warranty Reviews: Conclusion

CarShield earned a 4.5- out of 5.0-star rating, placing it fourth among all providers. The company’s reasonable pricing on its warranty plans was the reason we recognized it for Affordable Monthly Payments.

Although the company has received complaints, CarShield reviews are predominantly positive and the company has a good name in the industry. Considering that CarShield is one of the best extended warranty companies and has covered more than 1 million vehicles over 18 years, a few hundred negative comments barely impact the company’s reputation.

CarShield Extended Warranty Competitors: Top Picks

It’s always smart to shop around for extended warranty plans to make sure you’re getting the best deal on coverage. We recommend comparing free quotes from CarShield with quotes from other reputable extended car warranty companies. Below, we spotlight two of those providers: Endurance and CARCHEX.

Endurance: Best Overall

Endurance is a reputable extended car warranty provider that’s been in business since 2006. The company stands out in the vehicle protection industry for being a direct extended warranty provider rather than a broker or reseller. This means that Endurance offers and fulfills most of its plans without any outside help.

Endurance offers six levels of coverage. Each plan comes with one year of Endurance Elite Benefits which include perks such as tire repair or replacement, a collision discount, and 24/7 roadside assistance. Endurance has solid reviews from customers, with a 3.8-star rating out of 5.0 on Trustpilot and a 3.7-star rating out of 5.0 on the BBB.

Find out more: Endurance warranty review

CARCHEX: Best for Used Cars

CARCHEX is a reputable third-party warranty provider offering five levels of coverage and a long list of perks including towing coverage, 24/7 roadside assistance, and rental car reimbursement.

CARCHEX has an A+ rating from the BBB but earns just 1.9 stars out of 5.0 based on customer reviews. The warranty provider has a 2.6-star rating out of 5.0 from Trustpilot.

Find out more: CARCHEX review

CarShield Extended Warranty: FAQ

Below are a few frequently asked questions about CarShield warranties:

What is the average cost of a CarShield warranty?

The average cost of a CarShield warranty varies based on several factors, including your vehicle’s age and mileage along with the deductible and level of coverage you choose.

Is CarShield worth having?

As our pick for the third-party warranty provider with Affordable Monthly Payments, CarShield can be a good choice for drivers seeking low-cost coverage. The company offers multiple coverage plans and month-to-month contracts, but buying any protection plan carries the risk of paying for services you may not need.

What repairs does CarShield cover?

CarShield repair coverage depends on the extended auto warranty you purchase. The provider offers basic powertrain warranty plans that cover the engine, transmission, and drive axles. CarShield also offers exclusionary bumper-to-bumper warranties that cover almost every mechanical and electrical system component.

Most of the company’s protection plans provide coverage somewhere between a powertrain warranty and a bumper-to-bumper warranty.

Are extended car warranties worth it?

An extended car warranty can be worth it for owners of older vehicles who want peace of mind and to avoid paying for unexpected repairs. This depends on your needs and vehicle, though. Check average repair costs on sites such as RepairPal to compare them to your extended car warranty quotes.

How do you contact CarShield customer service?

To get support for an issue, use the form on CarShield.com. If you need immediate help during business hours, make a phone call to customer service at 1-800-587-4162. Customer service representatives are available Monday through Friday between 8 a.m. and 9 p.m Eastern time and on Saturdays from 9 a.m. to 4 p.m.

Is CarShield mechanical breakdown insurance?

CarShield offers vehicle service contracts which work similarly to mechanical breakdown insurance. However, mechanical breakdown insurance is sold by insurance providers and typically comes with fewer coverage options and benefits than third-party warranties.

What are the cons of CarShield?

While CarShield is a strong warranty provider overall, its major cons are that the company has a relatively high number of poor reviews online and that its rental reimbursement policy doesn’t come with all plans.

What is better than CarShield?

CarShield usually has some of the best coverage on the market, but it’s also smart to get free quotes from competitors like Endurance, CARCHEX, and Olive.

How good are CarShield reviews?

CarShield customer reviews are generally impressive. The company receives 4.2 stars out of 5.0 from more than 1,200 ratings on Google and it gets 4.0 stars out of 5.0 on Trustpilot.

CarShield is a legitimate, verified provider of vehicle service contracts and is not a scam. While some less reputable warranty providers can be rip-offs, CarShield is one of the largest car warranty companies in the U.S.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best extended auto warranty providers.

- Industry standing: Our team considers Better Business Bureau (BBB) ratings, availability, and years in business when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car warranty company offers an array of coverage options. We take into account the number of plans offered by each provider, term limits, exclusions, and additional benefits.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team performs ongoing secret shopper analyses for different vehicles, mileages, warranty plans, and locations to give this rating.

- Transparency: We consider the transparency of each company’s contracts and the availability of a money-back guarantee when determining this score.

- Customer service: Reputable extended car warranty companies operate with a certain degree of care for consumers. We take into account customer reviews, BBB complaints, and the responsiveness of the customer service team.

*Data accurate at time of publication.