Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase coverage from the extended warranty providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of extended warranty providers. See our Privacy Policy to learn more.

Crash Course:

- Endurance ranks as the best extended car warranty company according to the results of our 2024 warranty study.

- Olive, CarShield, CARCHEX, and Protect My Car made up the rest of our top five providers.

- The best extended auto warranty for you will depend on your car’s make and model, personal coverage preferences, and the vehicle’s age and mileage.

The best extended car warranty plans offer financial protection, predictable expenses, and peace of mind on the road. Not all companies that offer vehicle service contracts follow through on their promises, though, so it’s important that you choose your coverage provider wisely.

Our research team put together this extended car warranty guide to highlight the industry’s top providers. We’ll run through the five best car warranty companies and provide reviews for each one. You’ll also find key details about the warranty purchasing process to help you make an informed decision about your next coverage plan and provider.

5 Best Extended Car Warranty Plan Providers: Overview

While Endurance topped our list of the best extended car warranty providers in 2024, there wasn’t much separation between it and the rest of our top choices. You’ll find the top five highest-scoring warranty providers from our study listed in the table below, along with their overall scores and awards for this year.

| Best Extended Car Warranty Companies | Overall Rating (out of 5.0) | 2024 Extended Warranty Study Award |

|---|---|---|

| Endurance | 4.6 | Best Overall Provider |

| Olive | 4.5 | Best Online Process |

| CarShield | 4.5 | Affordable Monthly Payments |

| CARCHEX | 4.4 | Best for Used Cars |

| Protect My Car | 4.4 | Best Customer Experience |

How We Ranked the Best Extended Car Warranty Companies

Each year, our research team conducts a thorough review of the country’s top auto warranty providers to determine the best choices for customers. We evaluate every company based on dozens of data points found across five main categories, listed below.

5 Best Extended Car Warranty Companies: Provider Reviews

Now that we’ve explained our ranking system, we’ll give our complete reviews of the best extended auto warranty companies. While Endurance ranked as the top provider overall, there are compelling reasons to consider each of our top options. We outline those reasons, along with each provider’s strengths and weaknesses in the section that follows.

1. Endurance: Best Overall Provider

Endurance earned the top spot in our 2024 auto warranty study and stands out as one of the only direct providers in the industry. The company excels as a vehicle service contract provider due to its numerous plan options, relatively competitive prices, and the useful Endurance Elite Benefits package – which comes free for one year with each plan.

2. Olive: Best Online Process

Olive offers exceptional month-to-month coverage as opposed to longer contracts. This, combined with a user-friendly online experience, makes Olive one of the best providers for online-savvy people who want a low-risk way to add coverage to their vehicle.

3. CarShield: Affordable Monthly Payments

CarShield offers one of the industry’s highest mileage limits at 300,000 miles and provides coverage for ATVs and motorcycles. But the company also consistently had some of the lowest prices of any provider in our secret shopper study, especially when broken down to monthly payments.

4. CARCHEX: Best for Used Cars

CARCHEX is one of the most established companies in the car warranty industry and has a range of plans that can fit most needs. However, with coverage for vehicles up to 250,000 miles and term lengths of up to 10 years, CARCHEX is one of the best extended warranty providers for owners of high-mileage vehicles and older used cars.

5. Protect My Car: Best Customer Experience

Protect My Car earned fifth place in our extended vehicle warranty study. The company offers three protection plans and provides maintenance benefits like oil changes and tire rotations. We named it Best Customer Experience for having high customer ratings on the BBB and Trustpilot.

Best Extended Car Warranty Providers: Honorable Mentions

While we’d recommend that you first reach out for free quotes from the providers above, many drivers receive quality coverage from the following providers as well.

What Is an Extended Auto Warranty?

An extended car warranty covers the cost of repairs that occur due to mechanical breakdowns caused by faulty car parts or workmanship flaws. You may hear extended car warranties referred to as vehicle protection plans or vehicle service contracts as well.

In exchange for a one-time or monthly payment, the best extended car warranty providers will cover the cost of mechanical repairs that fall under the coverage outlined in your contract. Drivers aren’t required to purchase extended warranties, but many do since they add peace of mind while on the road and can reduce the stress of surprise car repair bills.

Is an Extended Car Warranty Worth It?

In terms of financial value, whether extended warranties are worth it is somewhat up to chance. If your car ends up needing repairs, there’s a strong likelihood that you’ll pay less for a warranty than for the cost to fix the issue. However, there is also the possibility that you won’t use your coverage, meaning you’ve paid for something that goes unused.

Still, extended auto warranties can be worth it in other ways. They include the following:

- Peace of mind: If you’ve ever driven a car under warranty, you may have felt better knowing that potential auto repair costs were already covered. An extended warranty plan offers that same peace of mind after your factory warranty expires.

- Extra benefits: In addition to your coverage, the best extended car warranties come with benefits like roadside assistance and trip interruption coverage. These perks, which may reduce hassle on the road, will otherwise come at an additional cost from auto insurance companies.

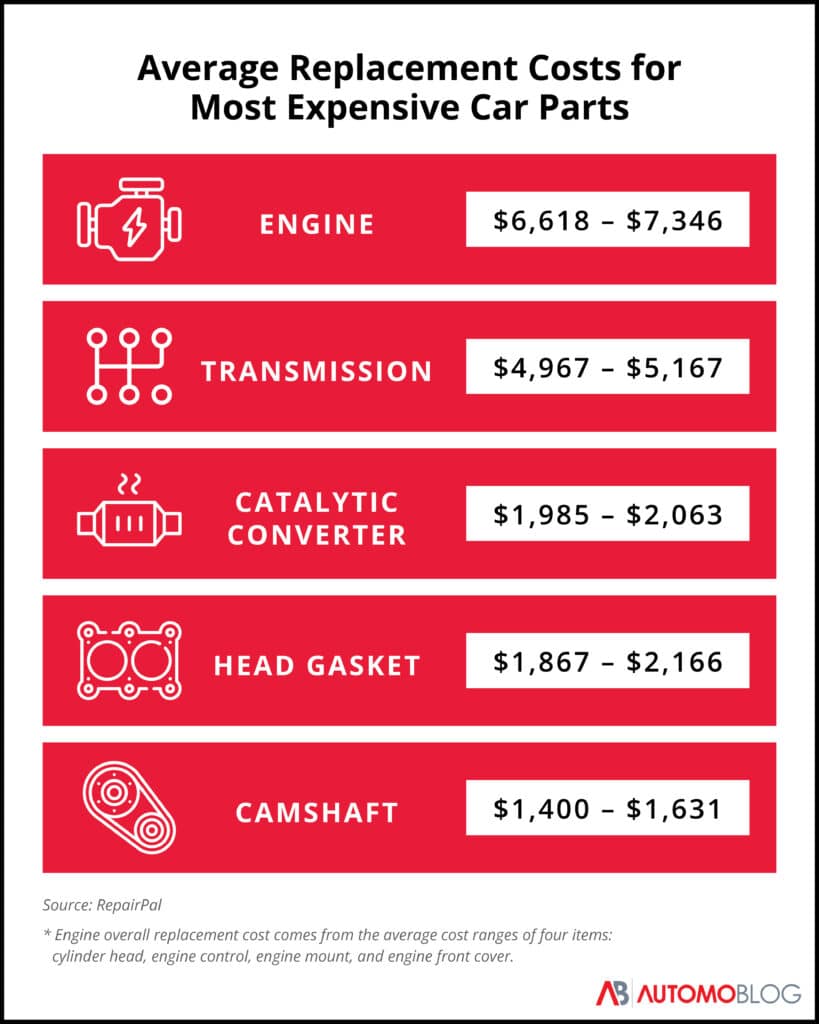

- Predictable expenses: Many people prefer to make regular monthly payments to avoid large surprise expenses for car repairs. A warranty plan can help keep your finances predictable and will reduce your risk of needing to come up with a large sum of money at a moment’s notice. With warranty coverage, you can avoid paying out of pocket for various car repair and replacement costs. The most common repairs costs are shown in the graphic below.

Extended Car Warranty Plan Costs

In our secret shopper research, we found that the average extended auto warranty plan costs between $300 and $1,685 per year of coverage. This is more or less consistent with what we learned from our auto warranty survey. A majority of the more-than 1,000 respondents said they paid between $1,600 and $3,200 in total for their extended warranty plans.

These averages include all coverage levels, which is one reason for such a wide range in cost. The difference in the amount of coverage you choose and other factors can significantly affect how much you pay for coverage, meaning these averages should only be used as a guide. You can request free quotes to get a more precise idea of your own extended warranty costs.

Expand the section below to learn more about the factors that affect the cost of an extended warranty plan.

Extended Car Warranty Plan Coverage

Whereas a factory warranty is a standard offering on a car without any options, you get to make choices about your coverage with an extended warranty. Most providers offer a few coverage levels to choose from, allowing you to find a warranty plan that fits your needs and your budget.

Types of Extended Warranty Plans

While each provider offers varying levels of coverage, most plans fall into one of three categories:

- Bumper-to-bumper warranty: Commonly known as exclusionary coverage, bumper-to-bumper warranties cover all vehicle components except ones that are specifically mentioned as exclusions. These plans are similar to the new car limited warranties you get from dealerships and they come with the highest price tags.

- Stated-component coverage: In contrast, named-component plans mention the parts of your vehicle that are covered rather than what isn’t. Typically, a stated-component plan covers most of your vehicle’s major systems and often includes coverage for some electrical components like your air conditioning.

- Powertrain warranty: The most basic and affordable level of warranty coverage is a powertrain plan. Sometimes referred to as a drivetrain warranty, a powertrain warranty only covers the most critical parts of your car such as its transmission and drive axles.

Many of the best extended car warranty providers are starting to offer specialized options that cover high-tech electronics, EVs, and classic or exotic cars. Some also offer plans that can take care of routine maintenance services such as oil changes and tire rotations, along with the replacement of wear and tear items like brake pads and windshield wiper blades.

Best Extended Warranty for Cars: How To Choose

There is no single best extended warranty provider for everyone. Certain providers may have better prices for your coverage needs and vehicles than others. Some auto warranty companies may offer benefits or coverage packages that work better for you.

In the following sections, we provide some guidance on how to identify a good provider. You’ll also see a short guide to finding and choosing the right extended warranty for you and your vehicle.

Features of the Best Extended Car Warranties

Not every auto warranty provider is as reputable as the next. While the companies mentioned in this article are reliable and transparent, others may be unresponsive when making a claim or stingy about payouts for covered repairs.

Our team stands behind our recommendations above, but it’s never a bad idea to evaluate companies on your own. In the section that follows, we list a few important things to look out for when deciding whether a provider has one of the industry’s best extended car warranties.

Expand the section to learn more about these features.

How To Find the Best Extended Auto Warranty For Your Vehicle

Here are a few tips that can help you narrow down your choices to reveal the best coverage provider for you and your vehicle:

- Assess your needs: Do you really need bumper-to-bumper coverage like you’d get with a manufacturer’s warranty on a new vehicle? Or will basic powertrain coverage or a slightly more extensive powertrain plus warranty satisfy your needs? Know what you’re looking for in a plan and provider before you start seriously shopping.

- Consider your budget: Think about how much you can reasonably afford to spend, either as an upfront lump sum or in monthly installments. Getting a precise estimate of your budget can help to guide your decision.

- Find a few options you like: Realistically, most extended car warranty companies offer basically the same product. But there are differences between companies that make them more attractive to some owners than others. You can use roundups like this one to find providers that offer the options, benefits, and customer service that you desire.

- Request quotes: You can and should get free quotes from many of the best extended car warranty providers as part of your process. While you may get sales calls and emails after requesting them, these quotes come with no obligations. Take time to weigh the details of the offers you receive in addition to the total price.

- Go with your gut: There are a lot of practical considerations to choosing an extended warranty company and plan, but at the end of the day, much of the value of a service contract is in how you feel about it. Even if it’s not strictly the cheapest option, the best extended car warranty company for you is the one that you feel best about. Listen to your instincts.

Best Car Extended Warranty: Conclusion

The best extended car warranty provider in our 2024 study is Endurance. With an impressive score of 4.6 out of 5.0 stars, the company earned the title of our Best Overall Provider.

But you shouldn’t stop your search there. While we rank Endurance as the best in the extended vehicle protection plan industry, we confidently recommend any of the providers mentioned in this article. Another provider may have prices, plans, or benefits that better suit your personal needs.

Buying an extended warranty for your car is an important financial decision, and there’s no rush to make a commitment. Take your time and thoroughly evaluate a few options before selecting your coverage provider and plan.

Best Extended Auto Warranty: FAQ

Below are some common frequently asked questions about extended car warranties:

Who has the best rated extended car warranty?

Endurance has the best-rated extended car warranty of all providers in our study. However, Olive, CarShield, CARCHEX, and Protect My Car are also strong options that finished with only slightly lower scores.

What does a car warranty cover?

Extended auto warranties cover select mechanical components. Basic extended warranties (typically referred to as powertrain or drivetrain warranty coverage) protect the parts of your car that help the vehicle move, like the engine, transmission, and drive axle.

A more comprehensive coverage plan (typically referred to as a bumper-to-bumper warranty) covers the same components as a powertrain plan, plus your car’s cooling and electrical systems, high-tech components, air conditioning system, and more.

Is an extended car warranty ever worth it?

An extended car warranty can be worth it financially if you need to use the coverage. But even if you don’t, the peace of mind from knowing that you won’t face huge repair bills out of nowhere may be worth the cost of coverage for many people.

What is an extended warranty on a car?

An extended warranty for cars covers the cost of unexpected repairs for a range of components, depending on the plan you choose. Some manufacturers offer extended car warranty plans, but you can also buy coverage from one of many aftermarket car warranty providers.

How much does a CARCHEX warranty cost?

A CARCHEX warranty costs around $100 to $200 per month, according to our research.

Are CarShield warranties expensive?

Compared to many of the other best extended car warranty companies, CarShield is not expensive. In fact, its rates are some of the lowest we saw, which is why we awarded it “Affordable Monthly Payments” in our study.

Can you buy an extended warranty after purchase?

If you choose an aftermarket auto warranty provider, you can usually buy an extended warranty after you purchase a vehicle. While some manufacturers offer this option, others require you to buy extended warranty coverage when you purchase your vehicle.

How do you cancel an extended warranty on a car?

Each provider has its own methods for canceling an extended warranty on your car. Some allow you to cancel in just a few steps online. Others require you to notify the company with a physical letter.

Can you pay for an extended car warranty monthly?

Yes. Paying for an extended car warranty on a monthly plan is very common and something most providers offer. However, you can choose to pay for your entire plan upfront.

Are extended warranties worth it on used cars?

Extended car warranties are often worth it for used cars. In fact, it may be even more worthwhile to purchase an extended warranty for a used car than a new car. The older your vehicle, the more prone it becomes to unexpected breakdowns. An extended car warranty can help keep your used vehicle on the road for longer.

Can you negotiate an extended car warranty?

Some extended car warranties may be negotiable, but not all. Dealership warranties are typically negotiable, and even third-party providers may give you different quotes each time you call.

CARCHEX, however, does not have negotiable contracts, and this is a good thing for many customers. The CARCHEX haggle-free guarantee means you are offered the lowest possible price without having to negotiate.

Does AAA offer extended warranties?

Because the products AAA sells vary from state to state, not all AAA locations offer extended warranties. Those that do usually offer similar coverage sold by third-party warranty providers.

Who competes with CarShield?

Popular warranty providers such as Endurance, Olive, and CARCHEX all compete with CarShield. These five providers earned the top places in our most recent industry-wide auto warranty study. Other competitors include Protect My Car, Concord Auto Protect, and Toco.

Is an extended car warranty the same as mechanical breakdown insurance (MBI)?

An extended car warranty is functionally the same as an MBI policy. Both cover the cost of vehicle repairs that come from the normal use of your car. The main difference is that extended car service plans are provided by car manufacturers or aftermarket providers while MBI policies are instead sold by auto insurance companies.

How much does an extended car warranty cost?

The average cost of an extended car warranty is currently $3,026 in total. However, the actual cost of a coverage plan can vary by several thousand dollars depending on factors such as the age and mileage of your vehicle, the coverage options you choose, and the term length of your contract.

Who adminsters CARCHEX extended warranty plans?

CARCHEX uses several third-party administrators to service claims for the warranty plans it sells. Depending on the plan you buy and where you buy it, your CARCHEX coverage may be handled by companies like American Auto Shield.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best extended auto warranty providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team performs ongoing secret shopper analyses for different vehicles, mileages, warranty plans, and locations to give this rating.

- Coverage: Because each consumer has unique needs, it’s essential that a car warranty company offers an array of coverage options. We take into account the number of plans offered by each provider, term limits, exclusions, and additional benefits.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, availability, and years in business when giving this score.

- Customer Service: Reputable extended car warranty companies operate with a certain degree of care for consumers. We take into account customer reviews, BBB complaints, and the responsiveness of the customer service team.