Affiliate Disclosure: Automoblog and its partners may be compensated when you purchase the products below.

When it comes to car insurance, there are two types of potential grace periods you may need. Learn how to know when you need them and how long they last.

Crash Course:

- You may need a grace period when adding a new car to your policy or when you’re late on your payments.

- Grace periods for missing a car insurance payment can range from 24 hours to one month, depending on the state and the provider’s policy.

- When buying a new car, it’s best to get the insurance grace period details in writing before you leave the dealership.

- If you get into an accident when your insurance has lapsed, you could face legal consequences and be liable for thousands of dollars in damages.

Life can get in the way of important deadlines – even your car insurance payments. If you’ve heard the term “car insurance grace period” thrown around, it typically refers to one of two things: making premium payments on time or getting car insurance for a new vehicle.

In either case, you never want to drive without an auto insurance policy. In this guide, we’ll outline the typical length of a car insurance grace period and how many times you can take advantage of your plan’s flexibility.

Understanding a company’s car insurance grace period may also be a selling point when choosing a new provider. We’ll outline some of today’s best car insurance providers, so you know the right circumstance for you. Enter your zip code above to start collecting quotes.

What Is a Car Insurance Grace Period?

A car insurance grace period is the amount of time your insurer or your state laws allow you to either delay paying for your car insurance premium without a lapse in coverage, or the time between purchasing a new car and auto insurance for that vehicle.

If you have a difficult month or you simply forget to pay your premium, will the company cancel your plan?

It depends. Both providers and state laws set specific regulations on how long you can delay payment before your car insurance coverage is canceled.

In some cases, your car insurance company is allowed to cancel your plan after one day without payment, and your plan will lapse because of a non-payment, leaving you uninsured. You may be able to pay a fee to reinstate your plan immediately.

If you currently have auto insurance on a car, you typically have a grace period of seven to thirty days before you have to report your new car to your insurance company with or without a penalty.

State Laws on Auto Policy Grace Periods

Some states require car insurance companies to provide a written letter with the intent to cancel your plan before doing so. In short, it all comes down to your policy and your state laws.

When reading through state laws on car insurance policies, look for grace period and cancellation regulations.

Some states require companies to give you 10 to 20 days to get back on track with payments. In other cases, car insurance companies can cancel your plan the moment you miss your due date. Check out the laws in your state to know what kind of grace period you’ll have for late payments.

Do All Carriers Offer a Car Insurance Grace Period?

In short, no, but many have car insurance grace periods to remain competitive, so it’s important to talk to an insurance agent about plan details. Some companies may even allow a specific number of late payments before enforcing stricter regulations. For example, they may wait until you’ve been late on your payments three months in a row before penalizing you.

Other companies may charge a late fee or set a higher premium the next time you renew your auto insurance.

Most companies don’t want to lose you as a customer over one late payment. However, since car insurance plans are based on trust, be sure to make payments on time and let your provider know if you’ll have any trouble paying.

How Long Is a Car Insurance Grace Period?

As we mentioned, grace periods vary between 24 hours to a month – quite a large range. State car insurance laws also come into play if your plan lapses.

All but two states (New Hampshire and Virginia, although this will change in Virginia on July 1, 2024) require some form of car insurance at all times, and even those require confirmation to drive without insurance from the Department of Motor Vehicles (DMV). In a nutshell, you can’t just jump in a car without insurance documentation.

The specific length of a grace period and steps that must be taken before a lapse in coverage come down to your location and your plan. If possible, get this information in writing from your company before you face late payments or create a gap in your coverage.

Can You Use the Grace Period Every Month?

Typically, car insurance companies place limits on how many times they’ll accept late payments. If your company has no limits on how many times you can take advantage of your grace period, it’s still a good idea to pay on time and not treat it like a safety net.

Many providers charge late fees or raise premiums when your contract renews, significantly adding to your overall insurance rates in the long run.

What Is a Grace Period When Buying a New Car?

So, what about car insurance grace periods when you’re adding a new car to your policy or buying a car without an existing plan? There are three things that come into play in this case:

- The rules of the car dealer

- Your state auto insurance laws

- Your car insurance provider

For example, some companies will allow you to drive off the lot with your new car if you have insurance for another vehicle. As long as you call the auto insurance company within a specific number of days – typically up to 30 – to order new coverage, you may be covered under the existing plan.

However, many car dealerships only require a driver’s license and proof of insurance to buy a car. In this case, what the dealer says goes.

Above all else, you should also consult state laws about car insurance grace periods. Some states may allow you to extend your current coverage from another vehicle to the new car for several days.

If you don’t have any form of insurance in a state that requires coverage, you’ll typically need to purchase a new policy before you drive for the first time.

Be aware that even if your state, dealership, and car insurance company allow a grace period, it’s helpful to get the grace period details in writing before you drive away from the dealer. If you get pulled over or are involved in an accident during this time, it will be easier to prove grace period regulations to the police.

Buying a Car From a Private Seller

Even if you purchase a used or new car from a private seller, you must follow state laws and policy regulations before driving home.

We also recommend taking care when you test drive a car from a private dealer. Ask the seller to show proof of insurance before your loop around the block to avoid breaking the law.

Take a look at your state’s required insurance minimums when checking the insurance in place, since there are still a significant number of drivers that slip by without the required amount.

What Happens if You Have a Car Accident During a Grace Period?

If you have collision coverage with a provider that offers a car insurance grace period, you’re covered under your other car’s plan during this time.

For example, Progressive offers a 30-day grace period for new cars if you have a plan for another vehicle. If you get into an accident during these 30 days, your other car’s plan will cover you up to the purchased maximums of that plan.

Keep in mind that costs on your new car could be higher than those from your old car, so it’s important to get your new plan rolling as soon as you can.

What Are the Dangers of Letting Your Auto Insurance Lapse?

If your coverage lapses due to missed payment or a delay after you purchase a new car, how long can you be without car insurance? It’s important to stay off the roads until you can pay your balance or set up a plan. Penalties for not having liability coverage increase the longer you’ve driven without it.

Getting into an accident can cost tens of thousands of dollars for you and the other person involved if you don’t have active auto insurance in place. In addition to these large expenses, there are also legal consequences for driving without insurance based on state laws.

Depending on where the accident occurred, you could face:

- Fines

- License points

- License and registration suspension

- Vehicle impounding

- Jail time

- Restrictions on car insurance in the future

Many companies offer same-day or next-day car insurance, so be sure you have a plan in place and proof of insurance before you get behind the wheel of a car.

What Should You Do if You Miss a Car Insurance Payment?

Let’s say things aren’t quite lining up this month, and you know you’ll be two to three days behind on your payment. We recommend starting with these two steps:

- Look at your policy for specifications on missed payments.

- Check state laws on car insurance grace periods on your local DMV website.

Though it’s important to pay your premium as quickly as possible, see how your grace period works to ease your worries about insurance lapses. Call your lender to alert them of the delay and confirm your findings if you’re concerned.

If your car insurance does lapse, call your company as soon as possible to figure out how to reinstate your plan or buy a new plan.

You can also reassess your current policy limits. If full coverage is too expensive, you may be able to get by on minimum coverage to save some money for a while. Keep in mind, though, that the less coverage you pay for, the less coverage you’ll get in the event of an accident.

Our Recommendations for a Car Insurance Grace Period

In our industry review, we highlighted car insurance providers that put customers first – through comprehensive coverage plans, affordable rates, and assistance during the quotes and claims processes. High customer care ratings are also generally a sign that a company will be easy to work with in the event of a payment slip-up.

Here are a few top contenders for auto insurance. Enter your zip code to start comparing free car insurance quotes in your area.

#1 State Farm: 4.6 Stars

State Farm doesn’t list its car insurance grace period length online. However, the company does allow you to combine your monthly payment plans with your other State Farm plans and offers billing reminders or automatic debit.

Here are some top things to know about State Farm:

- Offers extensive coverage, including perks like roadside assistance and rental car coverage

- Earned an A++ rating from AM Best, which is the highest rating possible

- Known for its large discounts for new drivers, students, and bundling plans

Read more about this provider in our State Farm Insurance review.

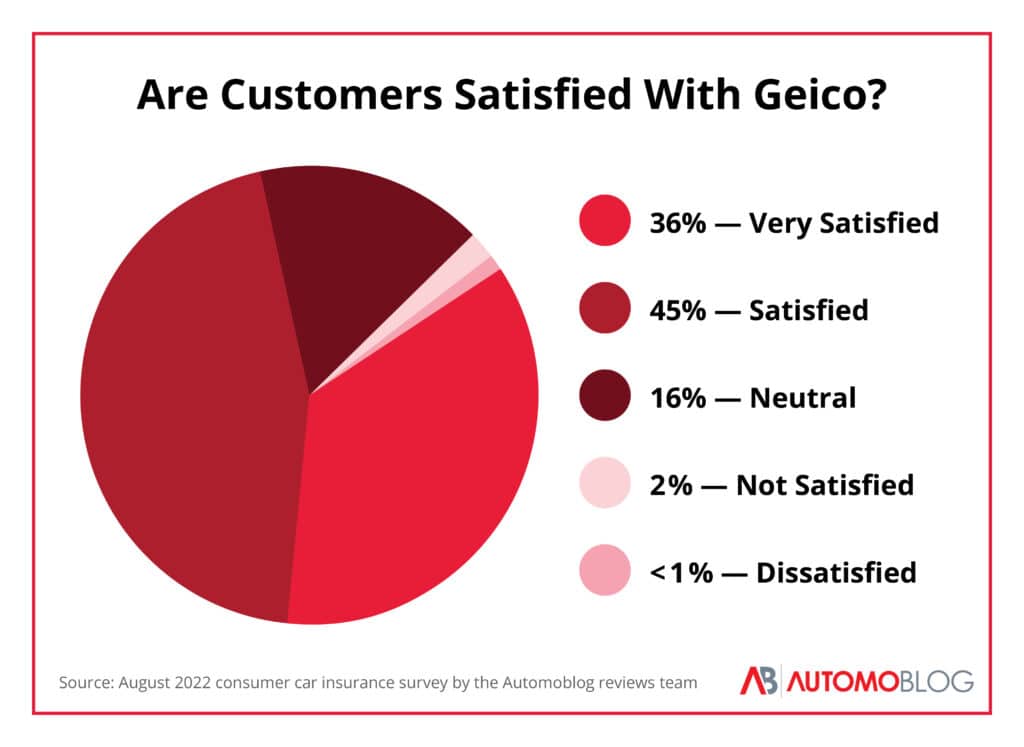

#2 Geico: 4.4 Stars

Geico is also very clear about its car insurance grace period. If you miss a payment, you’ll receive a notice clarifying how long you can delay your bill without plan cancellation. Overall, Geico is known as one of the most affordable and customer-focused car insurance companies in the country.

Here are some top things to know about Geico:

- Has just over 12% of the United States auto insurance industry market share, according to the National Association of Insurance Commissioners (NAIC)

- Offered in all 50 states with some local offices

- Holds an A+ rating from the Better Business Bureau (BBB), which indicates how well the company responds to customer complaints

We always recommend getting several auto insurance quotes before making a decision. In addition to your premium, be sure your company has a history of good customer service. A strong service team can help you through tricky payment months or buying a new car.

See our Geico Insurance review to learn more, and compare it with another top provider in our Geico vs. Progressive review.

Car Insurance Grace Period: FAQ

Here are some frequently asked questions about car insurance grace periods:

Do you have a 10-day grace period for car insurance?

A 10-day grace period for car insurance payments is a common length, though companies can give anywhere from 0 to 30 days. Don’t assume you have a 10-day grace period. Check with your car insurance company first, as it could be as short as one day.

What happens if I pay my car insurance a day late?

In most cases, your company will allow a grace period of at least a few days. However, in some states, auto insurance companies can cancel your policy after a single day of nonpayment. If a company cancels your existing policy, getting new car insurance can be more expensive.

Does The General car insurance have a grace period?

Yes, The General Insurance offers a grace period of up to 30 days depending on the state. Be aware that the grace period may be as short as a few days in some states, so talk to your auto insurance agent to get the exact timeframe.

How We Rate Car Insurance Providers

Our review team extensively researches auto insurance providers to deliver informed and unbiased assessments of leading companies. We evaluate several key rating factors that are important to consumers to determine which providers are the best in the industry:

- Reliability: It’s important that an auto insurer is able to meet its claims obligations. Companies with a strong financial strength rating from AM Best score best in this category. Established insurers with a long history of reliable service also receive positive marks.

- Availability: Insurance companies that offer wider availability to consumers in terms of state availability and few eligibility requirements are more likely to meet consumer needs.

- Coverage: To determine our coverage score, we look at the number of coverage options available as well as coverage limits and deductible options. Our ratings also take into account additional services and benefits like roadside assistance.

- Pricing: Cost can be difficult to compare between insurers because so many factors impact annual premiums. The cheapest insurer for one driver may not be the cheapest for another. To determine our cost score, we look at insurance rate estimates generated by Quadrant Information Services, discount opportunities, and consumer reports.

- Service: We comb through customer reviews on sites like the Better Business Bureau (BBB) to learn about customer experiences. Insurers with a low volume of complaints score well in this area. We also consider the claims process, giving higher ratings to car insurance providers that offer a smooth experience.

- Technology: Providers with an online quote tool, easy-to-use claims app and a usage-based insurance app score best in this category.

*Data accurate at time of publication.