Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

The Infiniti G35 is a popular ride for a reason. There are several models available, making it a great choice if you want a custom driving experience. But it’s important to do your research on all aspects of vehicle ownership, and many drivers wonder how much car insurance costs for an Infiniti G35.

In this article, we’ll discuss average insurance costs and give our recommendations for insurance providers. Our team of auto insurance experts has reviewed every major insurer on the market and ranked them in areas such as cost, industry reputation, customer service and coverage to help you on your buying journey.

If you’re in the process of purchasing an Infiniti and ready to start comparing auto insurance rates, enter your zip code above to get free quotes from top providers in your area.

How Much Does Car Insurance Cost for an Infiniti G35?

The exact cost of your Infiniti G35 auto insurance will vary depending on a variety of personal factors. In our research, drivers reported paying anywhere from $120 to $230 per month for basic coverage, which is just liability insurance in many states.

One G35 owner who lives in the Dallas-Fort Worth area and is in his mid-20s reported that he pays $127 monthly for full coverage auto insurance. On the opposite end of the spectrum, a driver in New York City in his early 20s pays a staggering $229 per month for the most basic coverage. However, age and location play a part in setting auto insurance rates.

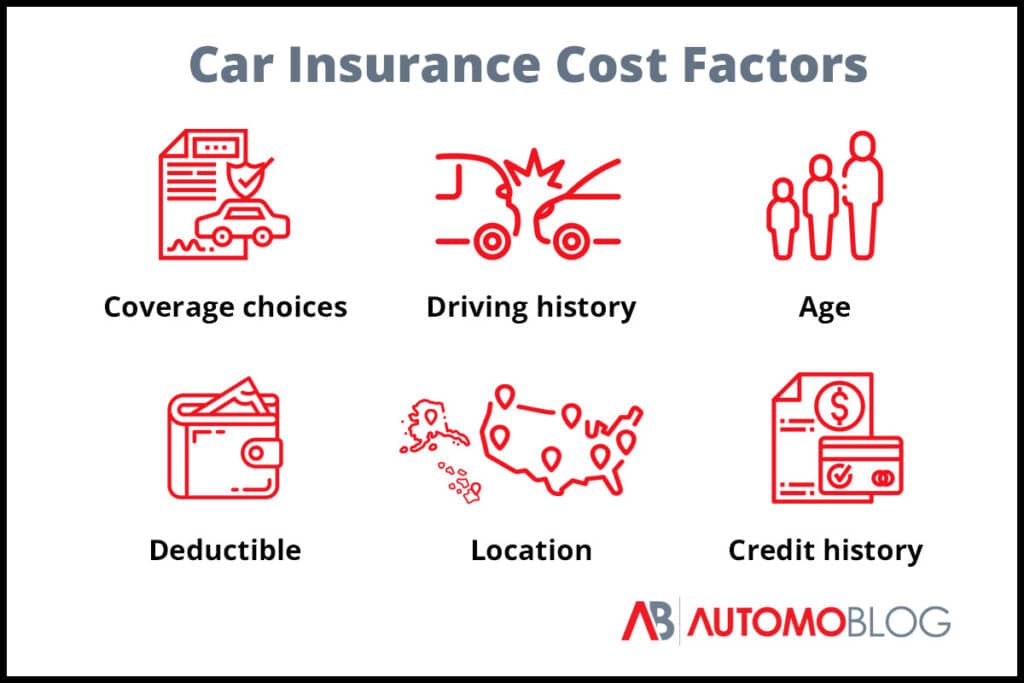

Factors That Affect the Cost of Car Insurance for an Infiniti G35

A wide variety of factors influence your auto insurance rates. These include details like age, marital status, gender, place of residence, population density, driving history and even average theft rates of the G35. Let’s take a closer look at each of these important categories.

Age and Gender

Certain age groups usually pay more for insurance. In particular, drivers from 16 to 24 years of age usually pay the most for car insurance. This is due to a lack of driving experience, which insurance companies deem as higher risk.

Male drivers generally receive higher quotes for car insurance. Many insurance companies view males as higher-risk clients, especially if they are in the age group listed above. Fortunately, these rates should go down as you get older.

Marital Status

Typically, married couples receive cheaper rates than singles. This is usually due to built-in discounts, like multi-car or multi-driver discounts. While a married couple’s total premium payment may be higher than a single driver’s, the per-person payout is usually significantly cheaper.

Location

Insurance companies base their rates on a risk assessment. As these companies are businesses and need to make a profit, if there is a high chance that you will need to file a claim, companies are going to charge you more.

Many people may be surprised to learn that your zip code typically has a significant impact on your insurance rate. If you live in a densely populated area, that usually means there are more vehicles on the road. The more vehicles there are nearby, the higher your chances are of being involved in a crash, which is why drivers living in rural areas often pay less for coverage.

Driving History

Car insurance companies will generally review your driving history before providing you with a quote. Crashes and tickets for past moving violations can drastically impact rates. If you have ever been involved in a vehicle-related crime, such as a hit-and-run or a DUI, then your rates will probably be much higher. For this reason, if you want to avoid paying high premiums, you should be practicing safe driving habits at all times.

Our Recommendations for Auto Insurance

Two providers that we recommend are GEICO and Progressive. These insurers topped the list in our industry-wide review for their competitive rates and comprehensive coverage. Both have exceptional reputations for customer service and high ratings from experts like AM Best and the Better Business Bureau.

To compare quotes from Progressive, GEICO and other top insurers in your area, enter your zip code below.

GEICO: Most Discount Options

While you are most likely familiar with the GEICO gecko, you may not realize that this company is one of the oldest insurance providers in the nation. We recognized it as the provider with the most discount options in our auto insurance industry review, with a total score of 4.4 out of 5.0.

GEICO is known for coverage like mechanical breakdown insurance and rideshare insurance in addition to standard auto insurance coverage.

Progressive: Best for Accident-Prone Drivers

We found this company to be the best option for accident-prone drivers. Progressive earned a total score of 4.5 out of 5.0 in our review. Like GEICO, Progressive has a variety of coverage options to meet the needs of drivers. It also offers plenty of discounts, including savings for multiple policies, multiple vehicles, safe driving and students.

Car Insurance for an Infiniti G35: FAQ

Are Infiniti cars expensive to insure?

The cost of insuring an Infiniti depends on multiple factors. The good news is that insuring older models is usually very affordable. However, newer Infiniti cars can be quite costly to insure. This is due to their high initial cost and overall complexity, which tends to make repairs more costly.

What are the maintenance costs for an Infiniti G35?

According to RepairPal, the average annual maintenance cost for an Infiniti G35 is about $476. This amount will vary depending on the age of your vehicle, your driving habits, mileage and your geographical location.

How fast can a G35 go?

The top speed listed for a G35 is 151 mph. However, we recommend sticking to the speed limit if you want to avoid a hefty fine and a hike in car insurance rates.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account the types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.