Over the past decade-plus, the automotive industry has seen a trend of larger car dealership groups acquiring individual dealerships and smaller dealership networks. This trend has only accelerated in recent years, with the largest dealership groups in the country swallowing up a rapidly-increasing share of the overall market.

The trend has been a major boon to some of the auto sales industry’s top national players, such as AutoNation and Lithia Motors, as well as regional powerhouses like LaFontaine Automotive. But while car dealerships consolidation shows no signs of slowing any time soon, it’s not clear whether the trend will benefit car buyers and car owners or exacerbate an already-difficult situation.

Car Dealership Networks are Consolidating at an Increasing Pace

For more than a decade, the largest automotive dealerships in the country have taken ownership of an increasing share of total dealerships. According to Automotive News data, the top 10 dealership groups in the country owned 5.3% of dealerships in the country in 2011. The top 10 owned 8.9% of all dealerships by 2022 – a 67.9% increase.

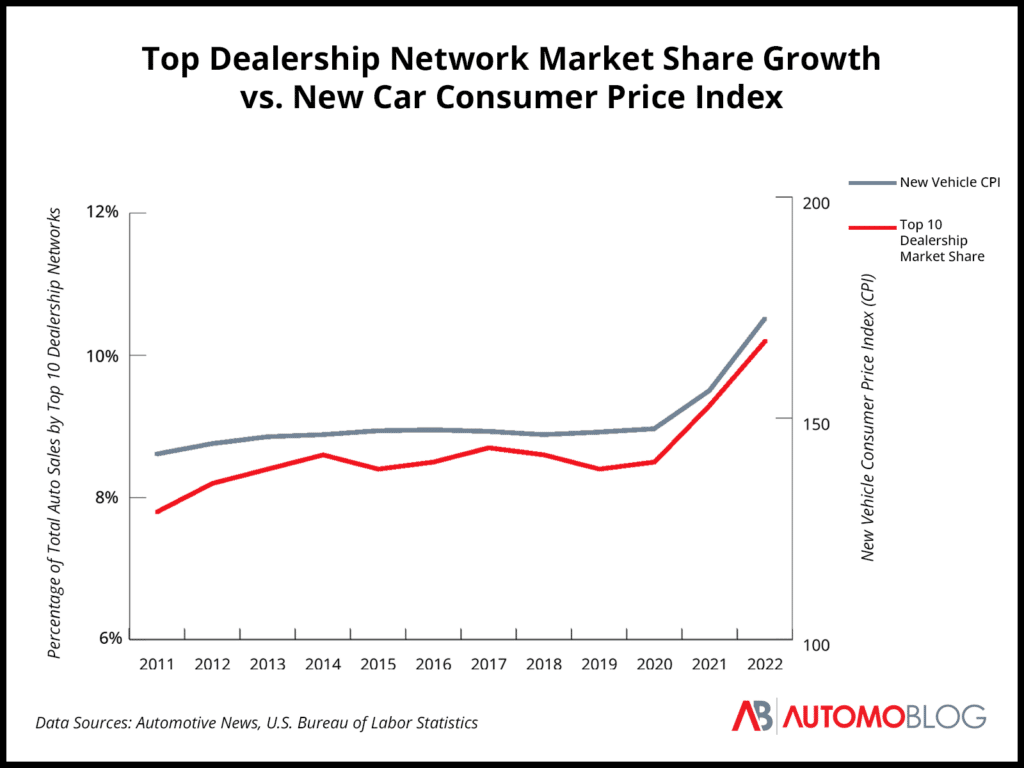

Those large dealership groups have also taken up an increasing share of the total auto sales market. The 10 largest dealership groups in the U.S. accounted for 7.8% of all industry sales in 2011. By the end of 2022, that market share increased by 31% to 10.2%.

Since 2011, the market share of the top 10 dealerships has grown by an average of 2.8% annually. While this is a substantial rate of increase, the trend has kicked into high gear in recent years. The share of the overall automotive sales market claimed by the top 10 dealerships in the country has grown by 21% since 2019 alone. That means that the growth rate of this market share has averaged 7% annually over the last three years.

2023 Has Been a Big Year for Car Dealership Consolidation

While the year-end data for 2023 likely won’t be available until Q2 2024, the sheer volume of headlines about dealership acquisitions would suggest that the trend is showing no signs of slowing down – and could perhaps be accelerating.

One of the biggest consolidation stories is Lithia Motors. Over the course of the last few years, Lithia has aggressively added dealerships to its portfolio. The company acquired 67 dealerships in 2021 and another 25 in 2022. In June of this year, Lithia announced the acquisition of 13 dealerships from Priority Auto Group in Virginia.

In 2022, Lithia retailed 271,596 new vehicles, a 4.2% increase over the previous year and enough to rank the company at the top of the list of dealership groups in terms of sales. Lithia sold 40,000 more vehicles than AutoNation, which had held the top spot since 1997. The company’s acquisitions and growth have increased the likelihood that it will reach its stated revenue target of $50 billion by 2025.

But just because Lithia surpassed the longtime leader doesn’t mean that AutoNation hasn’t grown in recent years, either. The company acquired 20 dealerships in 2021 and another four in 2022. Charlotte, North Carolina-based Hendrick Automotive Group, which was ranked sixth in sales among dealership groups in 2022, also made several acquisitions in 2023.

Dealership Groups Say Acquisitions Will Help Business and Customers

Another group that has made moves to expand recently is LaFontaine Automotive Group. The company has added 18 dealerships over the last five years. In doing so, the company has become the largest family-owned dealership group in the state of Michigan.

LaFontaine CEO Ryan LaFontaine told Automoblog that the company made the decision to start acquiring other dealerships for several key reasons.

“Our growth has been centered around two main factors,” he explained. “First, analyzing gaps in our portfolio, either with brands we represent or geography and second, that our on-deck circle of LaFontaine talent is ready to take on new professional growth opportunities.”

LaFontaine said that the acquisitions have allowed the company to operate more efficiently, allowing for even more growth in the future.

“Additionally, as our group continues to expand, we are able to use our size and scale to control costs, enhance processes and streamline our operations,” he said.

But according to LaFontaine, the acquisitions don’t just help the business, they can help the dealership group’s customers as well. Adding to the company’s portfolio, he said, allows the group to offer customers more purchasing choices.

“I fully believe that it enhances the experience for our guests at LaFontaine Automotive Group,” said LaFontaine. “As we add more brands to our group, our guests now have even more options to consider – not only in the brands we represent, but also in the quantity of inventory we are able to offer.”

LaFontaine said that having more locations under the same brand also makes it easier and more convenient for customers to stay in network throughout the car buying and ownership experience.

“Additionally, we have locations that span the entire state of Michigan – from Grand Rapids to St. Clair,” he continued. “This offers our guests easy access to sales, service, parts, and bodyshop operations, regardless of where they are located.”

As of now, the group has no plans to slow down. While he couldn’t provide the exact specifics of ongoing business developments, LaFontaine did say that more deals are slated for the very near future.

“I believe that buying and selling activity will continue to accelerate,” he said. “As a group, we have five upcoming acquisitions coming down the pipeline in the next 90 or so days.”

How Consolidation Will Impact Car Buyers Remains Unclear

The current trend of car dealership consolidation is producing big gains for some of the country’s top dealership groups. As LaFontaine pointed out, adding new dealerships and networks allows groups to expand their territory and plug gaps in a company’s business offerings. By purchasing other dealerships, groups can offer new brands and a larger inventory in more locations.

However, what impact this will have for prospective car buyers remains to be seen. Consolidated dealerships can – as LaFontaine said – streamline their service offerings and scale their operations in a way that reduces the overall cost of doing business. This could, in turn, allow them to offer cars and services at lower prices than they would be able to otherwise.

Consolidated dealerships would also have larger inventories to present to customers, offering more to choose from within that network. But with fewer businesses owning individual dealerships, car buyers have less choice of which enterprise they might buy their vehicles from – and potentially, where they might get those vehicles serviced. Additionally, fewer business owners in the market could translate to less competition and less of an incentive to keep prices low.

Since 2011, the trend line for the new vehicle consumer price index (CPI) has mirrored the trend line for the percentage of sales by the top 10 dealership networks, according to data from the U.S. Bureau of Labor Statistics. As dealerships have consolidated, the new car CPI has grown at an only slightly slower rate than the percentage of sales by the biggest dealership groups in the country. From 2011 to 2022, the share of sales by top dealerships rose by an average of 2.5% annually, while the new car CPI rose by an average of 1.8% each year.

Importantly, there are many mitigating factors that have very little to do directly with dealership consolidation when it comes to the cost of new cars. During this same period, the semiconductor shortage and other supply chain issues have played major roles in the increase in new vehicle prices. But while there may not be a direct causal relationship between the two trends, the data suggest that they may continue to develop at similar rates.

If the last three years have taught observers of the automotive industry anything, it’s that the industry’s future is as unpredictable as it’s ever been. With the automotive affordability crisis still in full swing, car buyers are eager for some relief. Groups like Lithia, Hendrick, and LaFontaine appear poised to continue their acquisition strategies going forward. Whether or not people looking to buy a car will benefit from this trend is much more up in the air.