Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

MetLife auto insurance is no longer available under that name after Farmers Insurance Group acquired the company’s home and auto insurance businesses in 2021. In the following article, you’ll find in-depth information about coverage, discounts, industry ratings, and customer reviews to see what you can expect from the best auto insurance companies in the country.

About MetLife Auto Insurance

The Metropolitan Life Insurance Company started out as a life insurance provider in 1868. Today, the New York City-based company is one of the largest global insurance providers in the world, insuring more than 90 million customers in more than 60 countries.

However, in 2021, the Farmers Insurance Group acquired MetLife Auto & Home. This means that you can technically no longer buy MetLife auto insurance or home insurance policies. Policyholders who had MetLife coverage are now covered by Farmers auto insurance.

MetLife Auto Insurance Cost

MetLife car insurance is now Farmers auto insurance, which has an average estimated rate of $2,140 per year for a full coverage policy. That’s nearly 24% more expensive than the national average estimate of $1,730 per year. Both estimates use a standardized profile of a 35-year-old driver with good credit and a clean driving record.

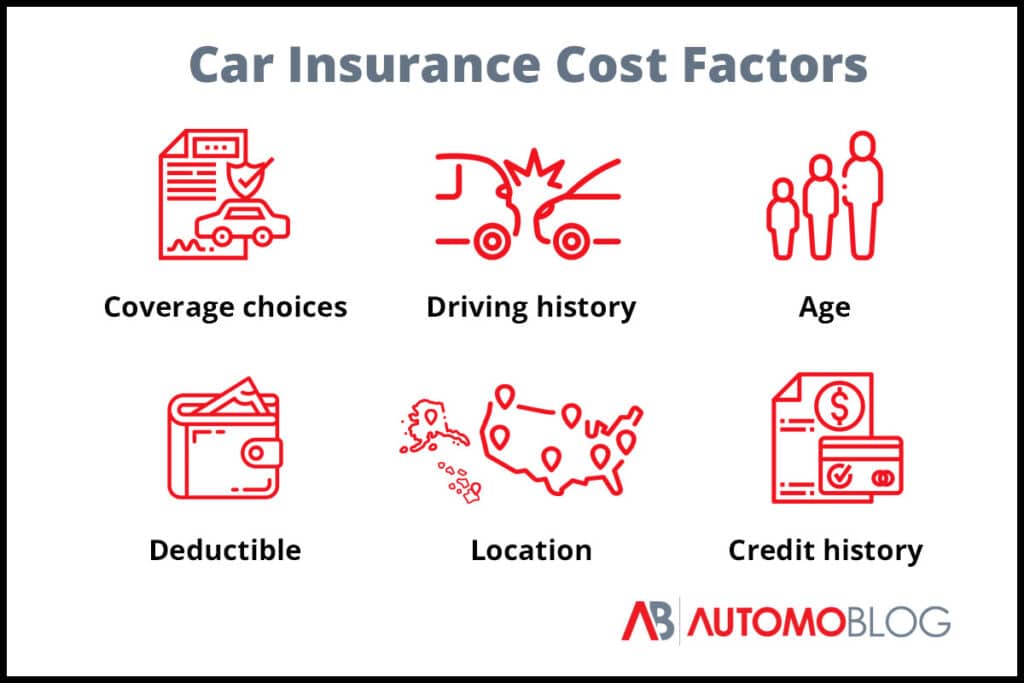

Car Insurance Cost Factors

Car insurance companies base the rates for their auto policies on several factors. These are some of the key variables that affect your premiums:

- Coverage types: Minimum liability coverage policies are typically the cheapest car insurance, but leave you at financial risk. Additional coverage offers more protection at an added cost.

- Coverage limits: You’ll get cheaper premiums with lower credit limits, but you’ll be at risk of personal liability if the costs of an accident exceed those limits.

- Age: Teens and other young drivers usually pay the highest rates of any age group for car insurance.

- Deductible: The lower you set your deductible, the more you’ll have to pay for coverage.

- Credit history: Drivers with low credit scores tend to pay substantially higher rates for auto coverage in most places. However, this practice is outlawed in several states.

- Location: Differences in regulations and risk factors mean that rates vary between states and even between two ZIP codes in the same state.

- Driving record: Having any infractions or at-fault accidents on your driving record will cause your rates to go up.

MetLife Auto Insurance Discounts

Car insurance discounts are another factor in the cost of your premiums. Most insurers offer at least a few options to help you save money. Since MetLife no longer offers auto coverage, here are a few of the discounts you’ll find at the company’s new owner, Farmers:

- Distant student: Households with students can get a discount if the student lives more than 100 miles from home and doesn’t have regular access to their car.

- ePolicy discount: Switching from paper bills to paperless bills can get you a policy discount.

- Good student: Students who keep a 3.0 GPA, make the Dean’s List, and more can get a discount on their auto coverage.

- Multi-policy discount: Combining other insurance products like your renters, life, or homeowners insurance with your auto coverage can get you a discount.

- Passive restraint discount: You can get a discount on your auto policy for having functioning airbags and seatbelts.

- Pay in full discount: Paying your entire premium upfront instead of month-to-month can get you a lower rate.

- Anti-theft discount: Many insurers offer a discount for having car alarms or other security features installed on their vehicle.

- Safe driver discount: Drivers can save money on their auto policy by staying accident-free and not getting any traffic violations for an extended period of time.

MetLife Auto Insurance Coverage

Most insurers offer both standard coverages and optional coverages you can use to build your own auto policy. You’ll at least need a few of the standard options to satisfy your state’s minimum insurance requirements. However, most insurance experts recommend adding personal property and injury coverage to make a “full coverage” auto policy that offers adequate financial protection.

Standard Auto Insurance Coverage

These are some of the standard coverages you’ll find at almost every auto insurer:

- Bodily injury liability: Covers other parties’ medical expenses after an accident you are responsible for

- Property damage liability: Covers other parties’ property damage after an accident you are responsible for

- Comprehensive coverage: Covers your own vehicle if it’s stolen or damaged in an incident that’s not a collision

- Collision coverage: Pays for your car to be repaired or replaced after an accident, regardless of who is at fault

- Medical payments (MedPay): Covers medical bills and funeral expenses for yourself and your passengers after an accident, regardless of who is at fault

- Personal injury protection (PIP): Covers certain medical expenses, lost wages, and funeral expenses after an accident, regardless of who is at fault

- Uninsured motorist/underinsured motorist: Helps cover medical and property damage expenses if the at-fault driver in an accident can’t be identified or does not have proper insurance coverage

Additional Coverage Options

You can no longer buy MetLife auto insurance, but when you do buy a policy, you’ll be able to add options that can offer additional financial protection. Some of the more popular additional insurance options include:

- New car replacement: Covers the replacement cost of a new vehicle matching yours in the event of a total loss.

- Major parts replacement: Pays for the replacement of major parts such as tires, brakes, and batteries.

- Roadside assistance: Covers the cost of emergency roadside services such as towing, tire repair, fuel delivery, and more.

- Rental car reimbursement: Covers the cost of a rental car if your vehicle is in the shop or totaled following a covered loss.

- Glass repairs: Pays for windshield repairs and replacement.

- Legal defense cost: Covers your legal fees if you get sued and reimburses you for up to $200 per day for lost wages if you attend a hearing or trial

- Lease or loan guaranteed asset protection (GAP) coverage: Pays off your vehicle’s lease or loan balance if it is deemed a total loss after an accident

The coverage options available will vary by the provider you choose and your location. Ask an insurance agent about which discounts are available before signing up for a policy.

MetLife Insurance Products

While it no longer offers auto insurance, MetLife still offers several kinds of insurance in the U.S. These include:

- Dental insurance

- Pet insurance

- Vision insurance

- Disability insurance

MetLife Auto Insurance Reviews And Ratings

Since MetLife no longer offers automobile coverage, we’ll take a look at customer reviews for the company that bought it – Farmers – instead.

Farmers has a strong reputation within the insurance business. The company placed sixth overall in the 2022 J.D. Power U.S. Auto Claims Satisfaction Study with a score of 882. This indicates that customers were mostly happy with how Farmers paid out insurance claims. Farmers also has an A rating and accreditation from the Better Business Bureau (BBB), along with an A financial strength rating from AM Best.

However, online customer reviews for Farmers aren’t quite as positive. The company has an average rating of 1.34 out of 5.0 stars from customers on the BBB website.

Positive comments tend to mention great service from individual agents or offices. When people reported negative experiences with Farmers, they often cited communication issues as the main problems.

MetLife Auto Insurance: Conclusion

MetLife auto insurance is no longer available since the company was acquired by Farmers insurance. While the company does offer several types of insurance products, you’ll have to find auto coverage elsewhere.

MetLife Auto Insurance: Top Alternatives

Since MetLife car insurance is no longer an option, you’ll need to find coverage from another provider. To get a better idea of your options, consider reading our round-up review of the best auto insurance companies. We conducted an industry-wide study using thousands of cost data points, in-depth analyses of coverage options, and countless customer reviews to determine the top options for car insurance.

Our experts recommend getting car insurance quotes from several providers and comparing to see who offers the best rates for you. These two providers were among the highest-scoring providers in our study and would make good places to start your search.

State Farm: Best Customer Experience

State Farm earned the highest overall score in our latest insurance study, winning it the title of Best Overall. The nation’s largest insurance provider offers competitive rates in most markets, lots of coverage options, and a large selection of discounts. State Farm also features the country’s largest network of insurance agents, with more than 18,000 local agents serving all 50 states.

Keep reading: State Farm car insurance review

GEICO: Most Discount Options

In our most recent auto insurance study, GEICO won the award for Most Discount Options due to the number and diversity of savings opportunities it offers. Those discounts are on top of what’s likely to be already-inexpensive coverage. Throughout our study, GEICO consistently offered some of the lowest rate estimates in most markets. Most people should find GEICO among their most affordable options.

Keep reading: GEICO car insurance review

MetLife Auto Insurance: FAQ

Who took over MetLife auto insurance?

Farmers Insurance Group took over MetLife auto insurance and the company’s home insurance business in 2021. MetLife still offers some insurance products in the U.S. such as dental and pet insurance.

Does MetLife have good auto insurance?

MetLife no longer offers auto insurance. The company’s home and auto insurance businesses were acquired by Farmers Insurance Group in 2021.

What is MetLife called now?

MetLife is still called MetLife and is still one of the largest insurance providers in the world. However, Farmers Insurance Group acquired MetLife’s home and auto insurance businesses in 2021.

Did State Farm buy out MetLife?

State Farm did not buy out MetLife. The company was instead acquired by Farmers Insurance Group in 2021.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.