Look, money and finance is not my strong suit, so asking me what should be “done” about the Detroit automakers circling the drain would be little more than conversation.

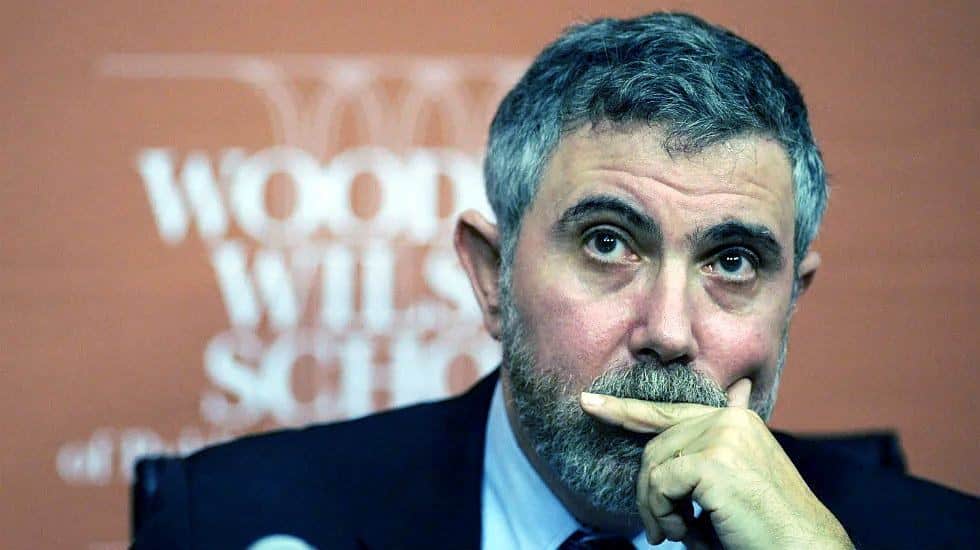

On the other hand, asking a professor of economics and international affairs at Princeton University, who is also a columnist for The New York Times AND a 2008, Nobel Memorial Prize in Economic Sciences Laureate is probably worth listening to.

Full transcript:

STEWART: So nobody knows the lame duck congress nor the lame duck president appears to want to do anything. What should they be doing? Joining me now, Paul Krugman, “New York Times” op ed columnist and professor of economics at the Woodrow Wilson School at Princeton University. Mr. Krugman, thank you so much for taking the time tonight.

PAUL KRUGMAN, NOBEL PRIZE LAUREATE AND “NEW YORK TIMES” COLUMNIST: Sure.

STEWART: I know this is complex and layered, but I hope you will permit me to start with a basic choice. Should the auto industry receive a $25 billion bailout, or should it be allowed to fail and file Chapter 11 bankruptcy?

KRUGMAN: I think it should be rescued. And it’s not, you know, a less deserving bunch of chief executives who would be hard to find. And industry – it’s been badly run—lots of bad decisions. But you want to, you know, sort of off-handedly takes the chance of letting this thing really disappear. Because, you know, Chapter 11 is supposed to keep a company in being, right? To stave off the creditors to keep in being, but it won’t work in this case. The trade credit, the sort of credit you need to keep operating, is not available because the financial markets are a mess. And will people buy cars from a bankrupt auto company? Very doubtful. So if you let this thing slide and you just say, “Well, you know, I don’t really want to give them the money.” You can wake up three months from now – two months from now – 61 days from now, that’s the whole thing we’re worried about – and find you’ve lost those companies on a permanent basis. It’s an irreversible decision, and I think we should just – it makes a lot of sense to kick this can 61 days down the road so we can deal with it intelligently.

STEWART: But why is the auto industry so special? Why should it be given money for essentially extremely poor management?

KRUGMAN: No, it’s not that it’s special. It’s just that it’s big and that it’s on the verge of failure. It’s just we are in the middle of a very – you know, the economy is in a nose dive. And this is something that will greatly accelerate the nose dive. If GM goes under, which looks like a real possibility, then that’s a huge blow to a huge anti-stimulus program at exactly the wrong moment. If this was 1999 and we had four percent unemployment, and the credit markets were working, I would say, let it fail. Let bankruptcy do its work. But this is not a good time to be having a really major industry just turn belly-up.

STEWART: I’m wondering if some of the opposition to all of this – could it be a bit of bailout fatigue? Fannie, Freddie, AIG? If the car companies had shown up first, perhaps they would have been given an easier ride.

(CROSS TALK)

KRUGMAN: That’s not – I think it’s a little more complicated than that and a little less creditable than that. It’s partly that we basically are seeing the White House and the 49 seats that the Republicans have in the current Senate. They are just sort of checking out, sort of, you know, not our responsibility. We don’t want to deal with stuff, and we don’t want to take any difficult decisions. And part of it is just there are regional things. You know, we do have the big three and not the whole auto industry. There are a lot of foreign companies operating in the United States. They are in different states. It would be really bad for Michigan and pretty bad for the U.S. economy if GM goes under. But not so bad for Alabama, let’s say, which had a lot of factories. So there’s a lot of – you know, there’s special interests on all sides here. And the trouble is that we’re on the verge, possibly, of making a really irreversible decision, almost in a fit of absence of mind.

STEWART: Now, do you think a bailout should come with conditions?

KRUGMAN: As much as you can, but time is – you know, it’s going to take some time to get a reasonable plan together. We’re really talking about a bridge loan here. We’re really talking about giving us a couple of months so that the thing doesn’t shrivel up before we have a chance to figure out what can be saved. If you say, you know, we have to have a comprehensive plan, and we have to have it in three weeks, and/or we have to have it, you know, now for a vote this week. We’re not going to have it. And yet, if we don’t do something, we may see these companies go under. It’s just this – it’s a terrible way to make decisions, but you know, it’s a terrible economy.

STEWART: You touched on something in your very first answers. I’m sure people watching at home or watching on their computers, these CEOs asking for a huge amount of money when their base salaries are in the millions. And once you put together the incentives, they can go up to $13 million or $14 million. Yet they’re asking people, “Give us $25 billion.”

KRUGMAN: Sure. No, like I said, these are not good guys. And they took corporate jets to plead for money in Washington, right? They are idiots. This is the theatrics. It was really stupid, right? But nonetheless, that’s not the point. The point is that there are – you know, estimates run from one million to three million jobs lost if GM goes under. And so there’s probably 12 guys out of those one million to three million people who are really bad guys and fly corporate jets and really don’t deserve any bailout. But the other 999,000 – I can’t do the subtraction right here – all those other people are, you know, people making a living, people who will lose their jobs, and lose their health insurance. That’s where you should be putting the priority.

STEWART: Paul Krugman, “New York Times” op ed columnist, Nobel laureate, and Princeton economics professor. Thank you for your time tonight, Mr. Krugman.

KRUGMAN: Thanks a lot.

STEWART: Next up, just enough pop culture with Kent Jones. Hugh Jackman, Brad Pitt, and Mickey Mouse. That’s hot!