Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

Root is a newer insurance provider that was founded in 2015 and has been steadily expanding operations across the United States. With such a short history, you may be wondering whether Root car insurance is legitimate. We decided to find out for ourselves.

Our research team took an in-depth look at Root and its costs, coverages, and customer reviews to see how the provider measures up to the country’s best car insurance companies. While the company could be a great option for some drivers, it’s not for everyone. Keep reading to learn why.

About Root Insurance

Founded in 2015, Root Insurance is headquartered in Columbus, Ohio. The company also has offices in San Francisco, Chicago, and Phoenix.

Root car insurance functions a little differently than traditional auto insurers. The company only offers coverage through its usage-based insurance program. Similar to telematics programs offered by other providers, the program tracks the driving habits of policyholders using the Root app on their mobile phones. Drivers who consistently demonstrate safe driving habits get rewarded with lower rates, while rates go up for drivers who practice unsafe habits on the road.

Root also offers homeowners insurance, renters insurance, and life insurance. Policyholders who combine their auto insurance with any of these policies may get an overall discount.

Root Car Insurance Availability

Not everyone can get a Root insurance policy. The company currently only offers auto insurance coverage in 32 states, including:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maryland

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- Texas

- Utah

- Virginia

- West Virginia

- Wisconsin

Root is actively expanding into other states as it grows. If you are interested in a car insurance policy from Root and don’t see your state listed here, you can check the company’s website at joinroot.com to see if they have recently expanded to your area.

Root Car Insurance Cost

Since Root only offers usage-based insurance, the company’s rates vary even more widely than a more traditional insurer’s, making it difficult to provide an accurate average. Fortunately, you can easily request a car insurance quote on the company’s website to get an estimate of where your costs would start.

Keep in mind that your premium will fluctuate. After signing up for a Root policy, you’ll have a “test drive” period of a few weeks. During this time, the Root app will collect driving data to learn your habits. It monitors behaviors like how hard you brake or turn along with things like how often you use your phone in the car and what times of day you typically drive.

Safe driving habits like not using your phone often, braking and turning softly, and limiting how much you drive at night and during high-traffic times will bring your premiums down. Many people have reported saving hundreds of dollars this way. However, if you practice unsafe habits, you’ll be penalized with higher rates.

Root Insurance Cost Factors

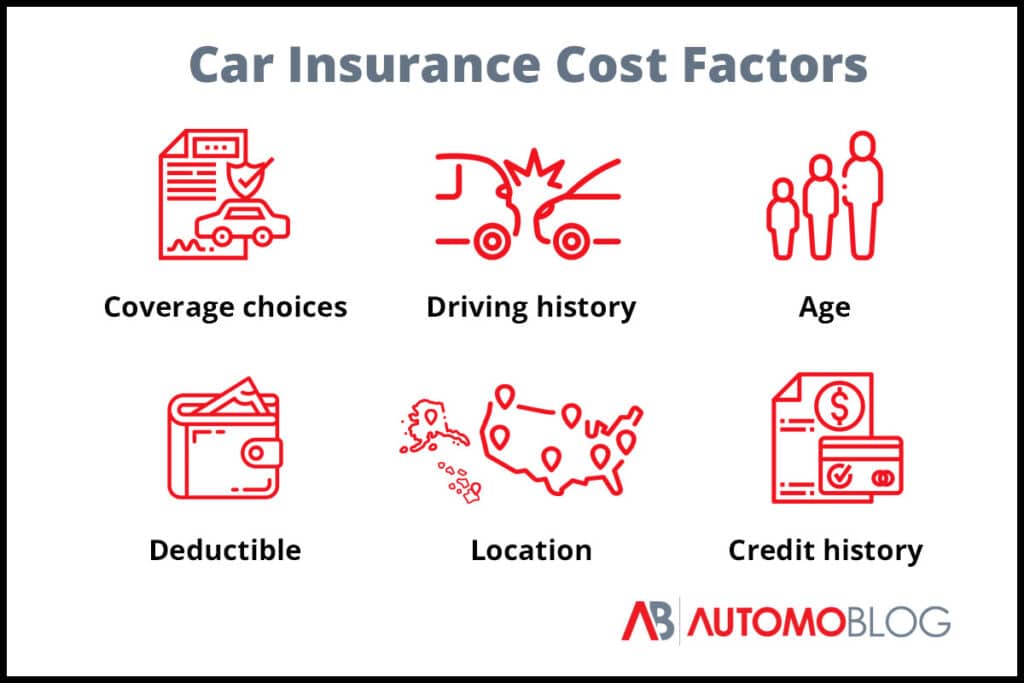

While your driving habits play a big role in how Root determines your premiums, many of the same factors that most insurers use to calculate costs also play a role. These include:

- Coverage options: Policies that only meet minimum state insurance requirements are typically the cheapest. Additional coverages, like collision or comprehensive, as well as add-ons will cost more.

- Coverage limits: You can choose the maximum amount that Root will pay out in an insurance claim. Higher coverage limits offer more financial protection but also come with higher premiums.

- Age: The age of a driver or drivers on your policy is a major factor in the cost of coverage. Younger drivers typically pay substantially higher rates than drivers in other age groups.

- Deductible: The lower you set your deductible – or, your out-of-pocket expenses on a claim – the higher your premium is likely to be.

- Driving record: Drivers with a clean driving history get access to the lowest rates. Any accidents or violations will drive up the cost of your insurance.

- Credit history: In states where it is legal to do so, insurers tend to charge people with lower credit scores more for coverage.

- Location: Insurance rates vary between states, but also between ZIP codes within the same state due to differences in regulations and local risk factors.

Root Car Insurance Discounts

As a usage-based insurance provider, Root doesn’t offer as many discounts as other providers. On its website, Root stresses that the best path to savings is consistently practicing safe driving behaviors. We could only find a few actual discounts, including:

- Multi-policy discount: You can get an overall discount if you combine your auto policy with other products like Root home insurance.

- Paid-in-full discount: Root customers may be able to lower their premiums by paying for their policy in full upfront, rather than across monthly payments.

- Good student discount: Some full-time students can get a discount on their policy by maintaining a “B” average in their classes.

These discounts may not be available in all markets. Make sure to ask which ones you can apply before signing up for a policy.

Root Car Insurance Coverage

Root provides auto insurance that ranges from state-required minimum coverage to full coverage, depending on drivers’ needs.

Standard Car Insurance Coverages

You’ll find the same set of standard coverages at Root as you would at most any other insurer. These include:

- Bodily injury liability insurance: Covers medical bills and injury-related expenses for other parties resulting from an accident for which you are found at fault.

- Property damage liability insurance: Covers damages to vehicles and other property caused by an accident you’re found at fault for.

- Collision coverage: Covers damages to your vehicle and some property resulting from an accident, regardless of who is at fault.

- Comprehensive coverage: Covers damages to your vehicle and some property from sources other than an accident, such as theft, fire, floods, or vandalism.

- Medical payments (MedPay): Covers medical expenses but not lost wages for people in your party resulting from an accident, regardless of who is at fault.

- Personal injury protection (PIP): Covers medical expenses and lost wages for people in your party no matter who caused the car accident.

- Uninsured/underinsured motorist (UM/UIM) coverage: Covers medical and property damages if an at-fault driver lacks sufficient coverage to do so.

Root Coverage Options

Root doesn’t offer many add-ons like some providers. Its additional coverages include:

- Rental car reimbursement: Covers the cost of a rental car or rides from Lyft while your car is in the shop for repairs after an accident. This coverage comes at an additional cost.

- Roadside assistance: Covers emergency services such as towing, jump-starts, and lockouts. Root includes this coverage with every policy.

Root Car Insurance Reviews

Root Insurance is accredited by the Better Business Bureau (BBB) and has an A+ rating. While it is not rated by AM Best for its financial strength, the company was recently valued at $3.7 billion, according to Business Insider. Though Root Insurance financials may not be as strong as other top providers, it is a fairly safe bet that the company will be able to honor customer claims.

Positive Root Insurance Reviews

Many customers praise Root for its low car insurance premiums and quality mobile app performance. The company is a tech-based startup, so it makes sense that its mobile app and online user interface are top-notch.

Here’s what some satisfied customers have to say about Root car insurance:

“[The Root mobile] app is truly one of the best apps, and it does exactly what it is promised to do. It saves me over $100 a month on car insurance and is extremely easy to use.”

– Jessica G., via BBB

“I was skeptical at first, but after [the test-drive period, Root offered me] much greater coverage than I had, at half the price I was paying. So far, [I’m] very happy and I recommend them to all my friends.”

– Gary M., via BBB

Negative Root Insurance Reviews

Most of the negative comments about Root car insurance note a slow claims process and rate increases. Here are a couple of reviews from not-so-happy customers:

“After requesting a quote several months ago and after participating in, also for several months, this company’s ‘test drive’ before they would give me a quote at all, I am convinced they must be selling clueless test drivers’ information to other companies for profit.”

– Michele B., via BBB

“The claims process is a nightmare. You have to go through a third-party company, and it took nearly a month to receive my check.”

– Ahmed A. via BBB

Root Car Insurance: Conclusion

If you consider yourself a good driver, Root car insurance could be worth a look. Since your rates are based primarily on your driving habits, you may be able to get very inexpensive coverage if you are a safe driver. However, you should assess your habits accurately. Drivers can easily see much higher rates compared to flat-rate insurance if they consistently practice habits that Root deems unsafe.

If you’re unsure of how the company would rate your driving, you can take a test drive by installing the Root mobile app, available for Android and Apple iOS devices. This can give you a good idea of what you might pay for Root insurance.

Root Car Insurance: Top Alternatives

If you’re looking for a more established provider, we suggest considering GEICO and State Farm. Both companies topped our list of the industry’s best insurance providers and have been around for nearly a century. To see which company can give you the best rates, get free quotes and compare.

GEICO: Most Discount Options

Among all the providers we examined in our latest auto insurance study, GEICO features one of the largest and most varied selections of discount opportunities. We also found that the provider was consistently among the most affordable in almost every market. That means that GEICO is likely to be one of the cheapest providers of quality coverage for many drivers.

Keep reading: GEICO car insurance review

State Farm: Best Customer Experience

State Farm earned the highest score in our industry-wide car insurance study. The country’s largest insurance provider offers competitive rates in all 50 states in the U.S. and has more local offices and agents than any other provider. While State Farm is likely to be a great option for most drivers, the company offers several discounts specifically aimed at younger drivers and students. That means people with these drivers on their policy will especially want to get a quote from State Farm.

Keep reading: State Farm car insurance review

Root Car Insurance: FAQ

Is Root an actual insurance company?

Root is an actual, legitimate insurance company. However, unlike traditional insurers, it only offers usage-based insurance that adjusts your rates based on your driving habits and doesn’t offer flat-rate coverage.

Who is Root Insurance owned by?

Root Insurance is owned by Alex Timm, who founded the company in 2015. Timm previously worked at other insurance providers before starting the company.

Does Root use your credit score?

Root uses your credit score as a factor in your rates in states where it is legal to do so. California, Massachusetts, and New Hampshire have made it illegal for companies to adjust your premiums based on your credit score.

Does Root track your speed?

Root tracks your speed and other driving behaviors with a mobile app to determine the cost of your premium. Speeding, hard braking, and other unsafe driving behaviors can cause your premium to go up, while practicing safe habits can bring your rates down.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.