Affiliate Disclosure: Automoblog and its partners may earn a commission if you get an auto loan through the lenders outlined below. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of auto lenders. See our Privacy Policy to learn more.

- Car loan calculators help potential buyers figure out how much they can spend on a new vehicle.

- It’s smart to get preapproved for an auto loan if you’re serious about purchasing a car in the short term.

- Those with good credit, large down payments, and shorter term lengths are likely to pay less on an auto loan.

A car loan calculator is one of the most valuable tools available when it comes to shopping for auto financing and should be one of your first steps in the car-buying process. It’ll help you to find the market’s best auto loan rates, whether you’re looking to refinance an auto loan or are hoping to purchase a new or used car.

Why Should I Use an Auto Loan Calculator?

There are several purposes for using an auto loan calculator, with some of the most common being:

- To find your auto purchase budget

- To determine monthly payments

- To learn how much you can save by refinancing a car loan

- To discover how much interest you’ll pay over the life of the loan

What Are the Types of Auto Loans?

The type of car loan calculator you’ll use depends largely on your category of auto financing. The main categories of auto loans include:

- Purchase loan: Finances the purchase of a new or used vehicle

- Refinance loan: Replaces your current auto loan with a new one

- Lease buyout: Finances the purchase of a leased vehicle, sometimes before the end of your lease term

How Do I Use a Car Loan Calculator?

Using an auto finance calculator is typically a straightforward process. However, preparing properly can help you get the most accurate information in an efficient manner.

1. Prepare Personal Information

You can use an auto financing calculator with only basic information about your income and credit score. The more precise the details you supply, though, the more accurate the numbers you’ll get in return. That’s why it’s a good idea to collect the following details ahead of time:

- Your income: Your monthly or annual pre-tax income is the figure you’ll use to help set your budget.

- Housing costs: The amount of money you spend each month on rent or mortgage payments factors into the affordability equation.

- Debt obligations: Money you’re required to pay toward credit cards, personal loans, and other debts each month reduces how much you can spend on a car payment.

- Credit score: Your current credit score is a major factor in the interest rates available to you.

How To Find Your Credit Score for Free

Providing an accurate credit score is critical to getting a realistic idea of the interest rate you’ll receive on an auto loan. While you can pay for a credit report, it may be better to learn your score for free by doing the following:

- Check with your credit card company: Many credit card providers now include free credit score access with their accounts.

- Use your bank or credit union: Like credit card companies, many banks and credit unions provide periodic checks of your credit score. This is typically available in your online banking portal if it’s something the financial institution offers.

- Request a free credit report: You’re entitled to one free credit report per year from each of the three major credit reporting services. Equifax, TransUnion, and Experian all have tools to obtain your free report.

- Sign up for a free credit monitoring service: Several reputable companies offer credit monitoring for free through basic versions of their services. While you may need to pay to get detailed information, expect to get free access to your current score.

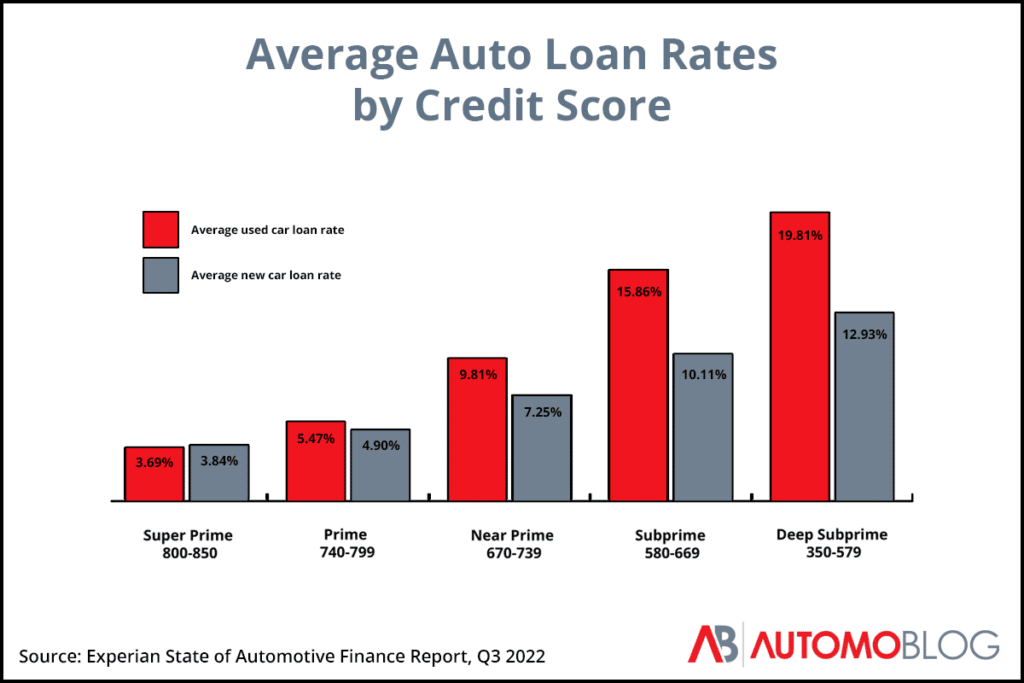

Average Car Loan Interest Rates by Credit Score

The following chart shows the average interest rates for new and used cars by FICO credit score. This data is based on the Experian State of the Automotive Finance Market Q3 2022 report.

2. Determine Your Budget

Even if you’re pretty confident about your potential purchase budget, it’s never a bad idea to check. This is where a car loan affordability calculator comes in handy.

Enter your income, expenses, and credit score to get an estimate of how much you can spend on a vehicle. This figure is typically the maximum car price you can afford, so it’s best that you set your budget slightly lower.

3. Find Your Estimated Monthly Payment

Once you’ve determined your budget, a car payment calculator shows you how different factors affect monthly payments and total interest costs. Many car loan calculators provide amortization schedules that detail how much you’ll pay toward the principal and toward interest over the life of the loan.

4. Get Preapproved or Prequalified

Many lenders offer car loan prequalification, which is an estimate from an auto lender of how much you can afford. This process only requires a soft credit inquiry, meaning that it won’t impact your credit score. As a result, prequalification doesn’t actually guarantee financing and is more of a guide to help you shop before actually applying for a loan.

Preapproval, on the other hand, requires a hard credit check. While this could negatively affect your credit score over the short term, it also guarantees auto financing. Many lenders offer preapprovals that you can use while shopping for a new vehicle. As long as the car you choose meets your lender’s requirements, this check is as good as cash to a car dealer.

5. Start Applying for Loans

Once you’ve performed your research, it’s time to find an auto lender. You can either get preapproved before shopping for a vehicle or find a loan once you know which car you want.

In any case, you’ve got a few options when it comes to auto loan providers.

Banks

Traditional banks are still the preferred source of financing for many people. Today, banks tend to have robust online services to apply for and manage auto loans. However, many also still have in-person branches that you can visit to apply for a loan or get help.

Credit Unions

Credit unions are member-based, not-for-profit alternatives to commercial banks. They offer a similar range of auto loan products to banks and often have low interest rates. While credit unions have historically been localized and open to only specific members, many national options are now available to the public.

Car Dealerships

Most car dealers offer in-house financing options. While financial institution are the ones that actually issue and service your loan, car dealers may increase the rate they get from that institution and take the difference as profit.

Getting financing at car dealerships can be hit or miss. Some are able to offer cash incentives or annual percentage rates (APRs) as low as 0%. Others, namely “buy-here-pay-here” dealerships, can charge high interest rates and add sneaky fees.

If you choose to get financing through the dealership, make sure to read your paperwork thoroughly and be vigilant. Car dealerships are known to sometimes add on items and services you didn’t ask for such as extended auto warranty plans.

Online Lenders

Online-only auto lenders are becoming an increasingly common financing option. Some are the online arms of established banks while others are direct lenders that lack physical locations. You’ll also find auto loan marketplaces that allow lenders to shop for your business.

What Affects the Cost of an Auto Loan?

To make the best personal finance decision, consider the total cost of a car loan in addition to just monthly payments. There are several factors that contribute to the cost of an auto loan.

Car Purchase Price

Auto Loan Payment Calculator: Conclusion

An auto loan calculator is a tool to take advantage of as you consider buying a car. Depending on your place in the process, these finance calculators can help to set your budget, reveal your potential monthly payments, and compare loan terms.

The information you receive can help you shop for auto financing and make informed decisions when purchasing a car.

Recommended Auto Loan Providers

The best way to get excellent rates on auto financing is to shop around. Applying for car loans with multiple lenders won’t impact your credit score if done in a brief period of time, so it’s a valuable strategy.

myAutoloan: Best Loan Marketplace

One of our top picks, myAutoloan, is a car loan marketplace. Lenders send you offers once you enter information into the site, allowing you to easily compare multiple financing options. You’ll also find a car loan calculator from myAutoloan that can give you an idea of the rates, terms, and purchase budget that could be available to you.

Learn more: myAutoloan review

Auto Approve: Best for Refinancing

Auto Approve specializes in auto refinancing and ranks as our top option for those hoping to do so. While you can’t get a purchase loan for a used or new car with the company, Auto Approve is one of the best choices for refinancing a vehicle. The rates from Auto Approve are usually competitive and the lender accepts credit scores as low as 600.

Learn more: Auto Approve review

Car Payment Calculator: FAQ

Below are some frequently asked questions about using a car loan calculator:

Is it smart to do a 72-month car loan?

Many experts say that it isn’t smart to do a 72-month car loan if you can avoid it. This is because longer loan terms tend to come with higher interest rates, and you could easily find yourself upside down on the loan, or owing more on the car than it’s worth.

How much are payments on a $30,000 car?

Monthly payments on a $30,000 car depend on several variables. These factors include how large your down payment is, the interest rate you get, and your loan term. You may be able to estimate your monthly payments by using a reputable car loan calculator.

How do you calculate an auto loan payment?

A car loan calculator is the easiest way to calculate an auto loan payment. But if you want to figure it out by hand, you can calculate a car payment by dividing the total loan plus the interest amount by the remaining loan term.

Is it worth paying off your car loan early?

Paying off your car loan early can be worth it in many cases. However, it won’t be worth doing if your auto loan carries prepayment penalties that exceed what you’d save by paying off your loan early.

Is 2.9% APR good for a car?

As of 2023, a 2.9% APR is an excellent rate whether you’re buying a new car or a used car and have an excellent credit score.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best auto loan providers.

- Industry Standing: Trust and reliability are two of the most important qualities in a lender. Our team considers current industry ratings from organizations such as the Better Business Bureau (BBB) along with factors such as a company’s age.

- Availability: We examine how easy it is for borrowers to get a loan from each provider. Lenders that offer loans to meet a variety of customer needs receive high ratings.

- Loan Details: Our researchers comb through the fine print to learn about the loan amounts, term lengths, and types of loans each provider offers.

- Rates and Discounts: We take an in-depth look at the range of rates each provider offers for borrowers of different credit scores. Our team also factors in the discounts available with each lender.

- Customer Service: Our team considers customer reviews and complaints when determining this score. We also consider the ease and availability of help online, over the phone, or in person.

*Data accurate at time of publication.