Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

By: David Straughan and Jennifer Chonillo. Illustrations by Richard Case.

Picture this: after waking up one morning, getting ready for work, and eating a good breakfast, you walk out to your car and see that it’s a crumpled pile of metal. The culprit? A being with superpowers who used your car to defeat their greatest foe.

While it’s good to know the universe is safe once again, you probably want to know how you’re going to fix your car situation. With the right types of coverage, help could come from your auto insurance company.

This article will guide you on which car insurance policies would protect your vehicle when the forces of good and evil collide. Automoblog spoke with Nick Vitali, vice president of North Carolina agency All About Insurance, for his advice on how to ensure your car is covered for some of the most common superhero-related damages.

The graphics in the article were created for Automoblog by Richard Case, who has contributed his artistic vision to both the Marvel and DC universes. He is perhaps best known for his seminal work with Grant Morrison on the esteemed Doom Patrol series. To learn more about Richard Case, you can check out more of his work here.

A Superhero Uses Your Car as a Weapon, Destroying It

With more than 2,000 pounds of metal and other components, a car makes an effective and convenient projectile for someone with super strength. However, your vehicle hurtling through the air at high speeds and crashing into something will typically lead to major damage – or perhaps it being totaled.

Insurance expert Nick Vitali says: “Your car insurance would likely cover the damage to the car. Car insurance follows the car instead of the driver, so the car owner’s insurance would cover the destruction, even if someone else is driving (or throwing) the car.”

A Supervillain Falls From the Sky and Lands on Your Car, Crushing It

It’s great when the good guys win. But a large, heavy object such as a person falling on your vehicle can do some serious damage. That’s especially true if that object is falling from high enough to reach terminal velocity, such as when a superhero knocks a flying supervillain out of the sky. For humans and superhumans, that’s a speed of around 120 miles per hour.

Vitali: “If a supervillain were to fall on your car and crush it, your comprehensive coverage – which covers damage to the car from accidents that you do not cause, such as falling objects – would cover it.”

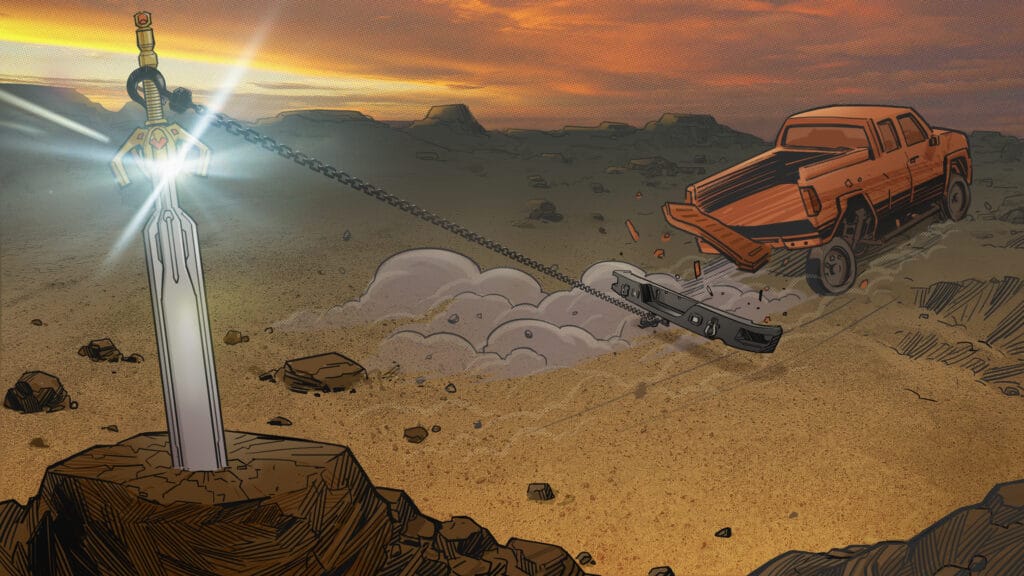

You Rip Your Car’s Bumper Off Trying To Pull a Mythical Weapon Out of the Ground

We’ve all been there. You and your friends are having a good time grilling out and trying to pull an ancient mythical weapon out of the ground. In an attempt to impress, you tie some rope to your car’s bumper and the weapon to try to yank it out like a tree stump. But this legendary weapon stays put, and your car’s bumper comes clean off.

Vitali: “It might be time to file a claim for bumper damage if your cost of repairs is significantly higher than your deductible. If the bumper damage was minor and you are responsible, you can pay for repairs out of pocket without filing a claim.”

A Superhero Conjures Extreme Weather, Damaging Your Car

Weather is a powerful force, which is why superheroes who can control it can be so effective against even the strongest villains. But weather like hail, tornadoes, and floods that can overpower a being who threatens the safety of the world can also wreak havoc on your vehicle.

Vitali: “Make sure you have comprehensive insurance coverage on your car in case this happens. Comprehensive insurance is a coverage that helps pay to replace or repair your vehicle if it’s stolen or damaged in an incident that’s not a collision.”

A Superhero Launches Your Car Into an Alternate Universe With No Way To Retrieve It

Wayne Gretzky once said you miss every shot you don’t take, but even superheroes miss some of the shots they do take. While cars make great projectiles, that super strength means a miss could send your car flying beyond the confines of our universe and deep into the multiverse. In most cases, there wouldn’t be an easy way to get it back.

Vitali: “Car insurance does cover a stolen car – even across multiple dimensions – but only if you have comprehensive coverage. If you do, you’re covered for the outright theft or interdimensional disappearance of your vehicle, as well as damage to your vehicle that occurs during a break-in. You’ll be paid up to the actual cash value (ACV) of your car, minus your deductible.”

A Villain Steals Your Car and Uses It as a Getaway Vehicle, Wrecking It in the Process

With their archnemesis in hot pursuit, a villain needs some kind of getaway car. And with your luck, they happened to choose yours. They subsequently speed through city streets and cause untold property damage to civilian cars, police vehicles, and buildings. After a heart-pounding car chase, the hero manages to force the villain into a barrel roll, apprehending them soon after.

The day may be saved, but your car is totaled.

Vitali: “If your car is stolen and wrecked, comprehensive coverage would cover this, too. Comprehensive insurance covers vandalism, theft, stolen keys or parts, and damage to the vehicle during theft, even by [a] supervillain.”

Getting the Right Insurance Coverage, Superhero Battle or Not

Even if you don’t live in an area that experiences a high number of epic showdowns, auto insurance can help protect you financially. Car accidents, severe weather, theft, vandalism, and other scenarios can strike at any time. And if you don’t have proper coverage, you could be saddled with huge repair bills or replacement costs to get back on the road.

Vitali says that while insurance agents typically offer 50/100/50 liability coverage, he recommends getting the highest level of liability insurance you can afford. That way, you can avoid large out-of-pocket expenses if you’re at fault for an accident.

“For the best coverage, in most cases, 100/300/100 coverage will be your best option,” he says. “It covers $100,000 per-person injury liability, $300,000 per-accident bodily injury liability, and $100,000 per-accident property damage coverage.”

Learn which insurers our editors picked as the best car insurance companies to protect you from the cost of damages, whether superhero-related or not.