Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

Farmers auto insurance is available in all 50 states, meaning that the provider is almost certainly an option for you wherever you live. To help you get a better idea of whether or not the provider is a good choice for you, we asked our team of experts to take an in-depth look at the company.

We examined insurance costs, coverage options, industry ratings, and hundreds of customer reviews to see how Farmers compares to the country’s best auto insurance companies. Keep reading to see what we learned and find out if Farmers would make a good provider for you.

About Farmers Insurance

Farmers Insurance Group got its start in 1928 when two men partnered to go door-to-door selling insurance to farmers. Today, Farmers is one of the country’s largest insurance companies, offering a full lineup of insurance products in addition to auto coverage.

According to data from the National Association of Insurance Commissioners (NAIC), Farmers wrote more than $12.4 billion in premiums in 2021. That gives the insurer the seventh-largest market share in the industry, claiming around 4.7% of the total auto insurance market.

Farmers Auto Insurance Cost

According to our research, the average rate for a full coverage policy from Farmers car insurance is $2,722 per year. This is somewhat higher than the national average rate of $1,983 per year. Both averages were calculated using a standardized profile of a 40-year-old driver with a clean driving record and good credit.

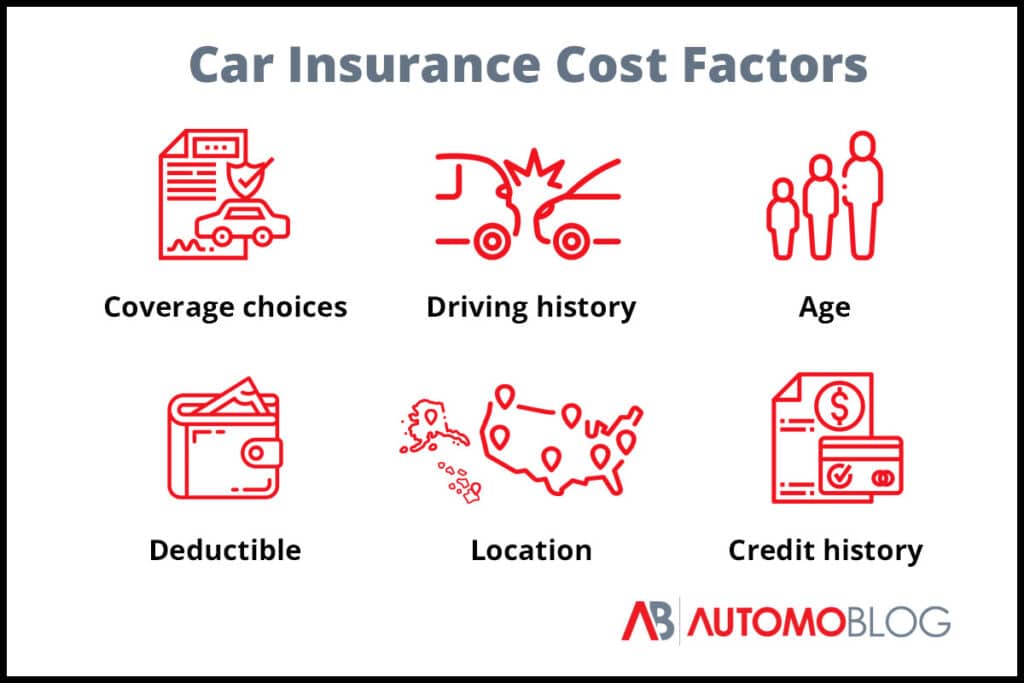

Farmers Car Insurance Cost Factors

Your rates will likely vary from that average. Farmers and other insurance companies base your rates on several variables. These are some of the most influential factors:

- Coverage options: Policies that only meet your state minimum requirements will have the lowest rates. Adding other types of coverage will increase your premium.

- Coverage limits: Higher coverage limits offer more financial security in the event of an accident, but they also cause your rates to go up.

- Age: Teens and other young drivers pay significantly higher rates than drivers in other age groups.

- Deductible: Setting a low deductible means you’ll have less to pay out of pocket towards a covered loss, but it also means you’ll pay more for coverage.

- Credit score: In some states, it is illegal for insurers to use your credit score as a factor in your rates. But in states where it is legal to do so, drivers with lower credit scores typically pay much higher premiums.

- Location: Rates vary between states, but also between different parts of the same state. This is due to differences in both regulations and local risk factors.

- Driving history: Any accidents or traffic violations on your record could increase the cost of your premiums.

Farmers Car Insurance Discounts

Farmers offers a broad selection of auto policy discounts that can help lower the cost of coverage. Some of the discounts you’ll find at Farmers include:

- Safe driver discount: Drivers who avoid any accidents or violations for an extended period of time can get a discount on coverage.

- Distant student: Households with students who live more than 100 miles from home and don’t have regular access to cars on the policy can get a discount.

- Good student: Farmers gives a discounts to students who perform well in school, including those who keep a 3.0 GPA, make the honor roll, make the Dean’s List, and more.

- ePolicy discount: You can get a discount on your auto coverage if you switch from paper bills to electronic billing.

- Pay in full discount: If you pay your entire premium upfront rather than across monthly payments, you can get a discount on your policy.

- Passive restraint discount: Having functioning seatbelts and air bags can get you savings on your Farmers auto insurance.

Farmers Auto Insurance Coverage

Just like with most insurers, Farmers offers a lineup of both standard coverage items and optional coverages. This allows drivers to build a policy that fits both their budget and their needs.

Standard Car Insurance Coverage

These are the types of coverage common in a standard policy. While liability coverage is usually the minimum legal requirement in most states, adding the other coverage types onto your Farmers auto insurance policy will provide a more comprehensive protection.

- Property damage liability insurance: Covers damages to other parties’ vehicles and property resulting from an accident for which you are found at fault.

- Bodily injury liability insurance: Covers medical bills and other injury-related costs to other parties following an accident you’re found at fault for.

- Medical payments (MedPay): Covers medical bills for people in your party resulting from a car accident, regardless of who is found at fault.

- Personal injury protections (PIP): Covers medical bills and lost wages for you and your party following an accident, no matter who caused it.

- Collision coverage: Covers damages to your vehicle and property resulting from an accident, regardless of who caused it.

- Comprehensive coverage: Covers your vehicle from any damage caused by things other than a collision, including floods, fire, theft, and vandalism.

- Uninsured/underinsured motorist coverage: Covers injury and property damages when an at-fault driver lacks sufficient coverage.

Optional Car Insurance Coverage

While these Farmers auto insurance coverage options are not required, they are a great way to customize a plan to your personal needs:

- Towing and Roadside Service provides 24/7 roadside assistance, and covers payments for towing, tire-changing, locksmith, and jump-start services.

- Rental Car Reimbursement covers the cost of renting a car for up to 30 days, in case your vehicle is getting repaired. Farmers will even handle the rental arrangements and billing.

- Rideshare offers full coverage rideshare service drivers, such as Uber or Lyft, throughout their work hours on the app. Most car insurance companies only offer limited liability insurance while the driver is looking for passengers, and only extend full coverage once passengers are in the vehicle.

- Loss of Use coverage is helpful if your car can’t be used after an accident or during repairs. Farmers will provide a flat sum reimbursement. This can be used for your preferred mode of transportation, whether it be car rentals, cabs, or ridesharing.

- Guaranteed Value pays policyholders a set, agreed-upon value if their vehicle can no longer be repaired or replaced. This is a popular option for those with classic or collector cars.

- Customized Equipment can be beneficial because most insurance policies only provide coverage for factory parts. If you’ve made any changes to your vehicle, such as a new sound system or rims, customized equipment coverage will protect those parts. This option is only available if you have comprehensive and collision coverage.

- Personal Umbrella Coverage will provide additional protection in cases where liability coverage doesn’t seem like enough, as in the likelihood of lawsuits or loss of assets.

- Glass Deductible Buyback covers windshield and any glass repair or replacement, with a low deductible of $100.

- Full Windshield and Glass covers windshield and any glass repair or replacement, with a $0 deductible and no payment needed.

- Spare Parts covers the cost to replace any spare parts you own up to $750. It’s a popular option for those with classic or collector cars.

- Original Equipment Manufacturer (OEM) covers the cost of factory-original parts for any needed repairs. Some car insurance companies will only repair damages with aftermarket parts, which are cheaper. This option is only available if you have comprehensive and collision coverage, and the car is up to 10 years old.

- New Car Replacement covers a brand new car in the unfortunate case of it being totaled. Farmers will automatically replace it with a new one. This option is only available if the car is within the first two model years and has a maximum of 24,000 miles.

- Accident Forgiveness is available if you only have one accident every three years. Farmers auto insurance offers coverage to keep your insurance rates from rising afterward, which is common practice among providers.

Other Farmers Insurance Products

In addition to auto coverage, Farmers also sells a wide range of other insurance products, including:

- Homeowners insurance

- Renters insurance

- Motorcycle insurance

- Life insurance

- Umbrella insurance

- Vacation home insurance

- Condo insurance

- Business insurance

- Pet insurance

- Travel trailer/RV insurance

Signal® Safe Driving App

A popular trend among auto insurance providers is encouraging customers to download safe driving apps. These apps track your driving habits, then reward safe driving with discounts. Farmers’ Signal® app provides the opportunity to earn up to a 15 percent discount each time your policy renews.

Farmers Auto Insurance Claims Process

Farmers readily accommodates insurance claims through its 24/7 claims contact center or online portal.

To file a claim for Farmers auto insurance online, go to the Claims menu and click “Report a Claim.” You can then either log in, continue as a guest, or look up your policy number. Filing a claim requires you to submit your policy information, incident details, and other relevant information.

Farmers offers guidelines to file every type of claim online. For example, you can select a guaranteed facility for auto repairs or call their response team after major catastrophes.

Filing insurance claims, viewing policy documents, and requesting roadside assistance can also be done on Farmers mobile app.

If you have a Farmers account, you can monitor your claim status. If not, a Farmers agent will get in touch with you in the next few weeks. The time it takes to resolve a claim varies, depending on how serious the injuries or damages are, and how long it takes to agree with the other parties.

Farmers Auto Insurance Customer Service

We like how even if you’re not filing a claim, you can easily contact Farmers through almost any method – online portal, phone, email, or their Farmers mobile app. You can quickly get a quote through their online form. You can also call 800-974-6755 or get in touch with the nearest Farmers agent at 888-327-6335.

You can also chat with the Farmers Claims Virtual Assistant to find the best way to get your questions answered.

Farmers Auto Insurance Reviews

Farmers auto insurance ranked fifth in J.D. Power’s 2021 U.S. Auto Claims Satisfaction Study. This is based on feedback from 10,896 auto insurance customers who settled a claim within six months prior to the survey.

Farmers scored 893 points, positioning it above other popular providers, such as Allstate, GEICO, Progressive, and State Farm. The company also has an A financial strength from AM Best, meaning the company has the ability to pay claims. Farmers also earned an A rating from the Better Business Bureau (BBB), indicating that the company handles complaints from customers well.

However, reviews from customers are not as consistently positive. Customers on the BBB gave Farmers an average score of 1.34 out of 5.0 stars. Low scores are common on the BBB website as people typically come to the site to report a problem, but the company has some patterns of complaints to consider.

Positive Farmers Insurance Reviews

We did find many positive reviews from Farmers customers. A common theme among these reviews was the outstanding service the reviewer got from their agent. The following quotes are reflective of many of the positive reviews we saw for Farmers:

“He patiently reviewed my current coverage, took away thing I didn’t need and add things I should have. So professional and truly cares about you as an individual.”

– Kat, via TrustPilot

“Excellent service and follow up, thank you [Agent] and thank you Farmers insurance.”

– Dina, via TrustPilot

Negative Farmers Insurance Reviews

We found more than a few negative reviews for Farmers. While complaints varied, some of the more common issues people reported centered around bad customer service experiences and a difficult claims process. These quotes are indicative of many of the negative Farmers auto insurance reviews we read:

Other complaints include poor customer service and unsatisfactory claims process. Recent Farmers auto insurance reviews from the BBB include:

“Horrible service. I canceled my policy and they continued charging me for months after submitting documents to cancel.”

– Melissa K.

“Person insured by this agency rear-ended me at a stop light. File claim, presented statement, police report, and photos to prove claim. Agency is utilizing deny/delay tactics. No follow-up on evidence provided, left voicemail claiming I left out information, fails to say what that information is, when I call back, no answer straight to voicemail. Very unethical business regardless of what side of the table the consumer is on.”

– James C.

Farmers Auto Insurance: Conclusion

Farmers auto insurance is an option worth considering, but for most people, it isn’t likely to be the most affordable coverage. The provider’s main strength is the variety of additional coverage options it offers, including a few you won’t find with many other insurers.

The company may be a good option for people who have other insurance policies with Farmers and can bundle their coverage for a discount. Otherwise, you can probably find less expensive coverage from a company with higher customer satisfaction ratings.

Farmers Auto Insurance: Recommended Competitors

Farmers may be a good option for some people, but most are likely to find better rates with a different provider. We strongly recommend getting car insurance quotes from several providers so that you can compare and find the best rate. These two providers ranked at or near the top of our most recent auto insurance study, and would make good options for most drivers.

GEICO: Most Discount Options

We found that GEICO has one of the largest and most diverse offerings of savings opportunities of all the providers in our study. As a result, we awarded the company Best Discount Selection. In addition, our data shows that GEICO consistently has some of the lowest estimated rates in most places. That means that many drivers are likely to find very affordable coverage with GEICO.

Keep reading: GEICO car insurance review

State Farm: Best Customer Experience

State Farm earned the highest score in our most recent auto insurance study, winning it the award for Best Customer Experience. The company offers coverage in all 50 states through its industry-largest network of more than 18,000 local agents. State Farm is an especially good option for households with young drivers, as the insurer offers several discounts aimed at lowering premiums for those drivers in specific.

Keep reading: State Farm car insurance review

Farmers Auto Insurance: FAQ

Who normally has the cheapest car insurance?

Based on our research, State Farm and GEICO tend to have the cheapest car insurance in most locations. However, individual premiums are based on a number of factors, so a different provider may offer you the lowest rates.

Does Farmers Insurance have a good reputation?

Farmers insurance has a good reputation among industry ratings organizations such as the BBB and J.D. Power. However, the company has mixed reviews from customers online.

Is Farmers good at paying claims?

Farmers is very good at paying claims The company ranks among the top five in the country in claims satisfaction.

What’s the best car insurance right now?

Based on our research, State Farm is the best car insurance overall. The company has competitive rates, lots of coverage options, and the industry’s largest network of local agents.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.