Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

Progressive doesn’t offer temporary car insurance coverage for drivers, but drivers can purchase policies in six-month or one-year increments.

Crash Course:

- As with most car insurance providers, Progressive does not offer temporary car insurance.

- You can purchase six-month or one-year policies from Progressive for car insurance coverage.

- Some car insurance companies offer pay-per-mile car insurance policies if you only drive temporarily, charging you for insurance on a per-mile basis.

Weekly and monthly car insurance policies don’t exist, but there are other ways you can get short-term car insurance. In this article, we’ll explain what you need to know about Progressive’s temporary car insurance and provide you with other options for short-term coverage from the best car insurance companies that offer this coverage.

What Is Progressive Temporary Car Insurance?

Most major insurers, Progressive included, don’t offer temporary car insurance. However, you can buy insurance policies in six-month or one-year increments. Progressive allows you to pay month to month and cancel on the months you don’t drive.

You can also choose a pay-per-mile auto policy if you only drive occasionally. If you opt for a six-month auto insurance policy and you cancel, you’ll have to pay a cancellation fee, but you can still get a refund for the months you didn’t use.

You may find lesser-known insurance companies advertising daily or weekly insurance, but these are not legitimate insurance options. Most of these advertisements are likely scams or providers offering insufficient coverage.

If quitting coverage will cause a lapse in coverage, make sure you don’t need to drive the car for whatever reason since most state requirements carry severe penalties for drivers with no car insurance. Gaps in your insurance typically result in legal consequences like fines, license suspension, and even jail time in the worst cases.

How Much Does Progressive Temporary Car Insurance Cost?

In general, Progressive temporary car insurance is usually a better deal if you only need it for the short term. It may cost you a few dollars or $100 or so to insure your car temporarily. However, if you continue to use it month-over-month, you may have more expensive car insurance.

Progressive Temporary Car Insurance Cost

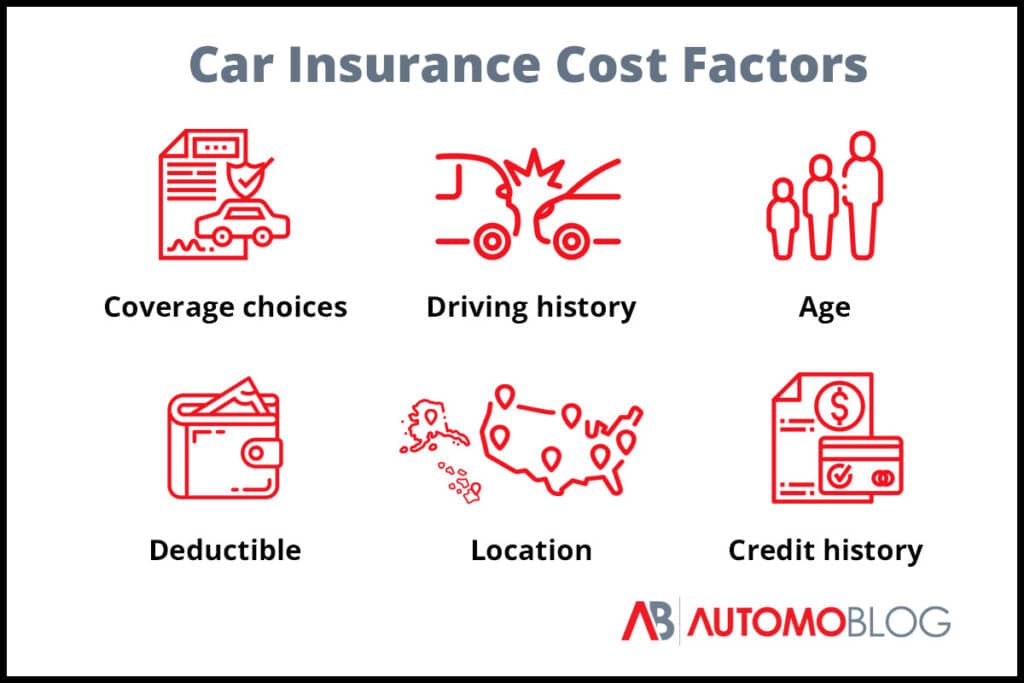

Several factors will determine your Progressive temporary car insurance cost, like your age, location, vehicle, and mileage. The list below provides further details on what impacts Progressive car insurance costs.

- Coverage options: If you’re looking for the cheapest rates, you’ll want to find a plan that only satisfies the state minimum coverage requirements. Other types of coverage, such as comprehensive insurance, can insulate you from more risk but add to the cost of your premiums.

- Coverage amounts: You can also choose the maximum amounts your Progressive insurance policy pays out in an accident. Higher coverage limits will result in higher premiums.

- Deductible: In most cases, you’ll get to choose a deductible or the amount you pay out of pocket for covered car repairs. A lower deductible means less to pay when repairs come, but it also means a higher premium.

- Driving record: Any recent at-fault accidents will raise your car insurance rates. Drivers with a clean driving record get the cheapest rates on car insurance.

- Age: Seniors and younger drivers will pay more for their auto insurance policy than middle-aged drivers. But it’s teen drivers who tend to pay the highest rates.

- Credit history: A poor credit score will mean you have to pay more for your car insurance coverage than drivers with a good credit rating.

- Location: The state where you live plays an important role in your car insurance premiums. But even within the same state, drivers in different zip codes will still pay different rates.

Do You Need Progressive Temporary Auto Insurance?

There are tons of reasons why you may want to insure your car for a limited amount of time, aside from not wanting high insurance costs. Here are some of the most common situations where temporary car insurance coverage may be helpful.

You’re Renting a Car

Rental car insurance can get expensive, so if you already have personal auto insurance coverage with Progressive, your insurance plan may cover your rental car with better deductibles and coverage limits. However, not all Progressive car insurance policies have these benefits. If you’re unsure of your own policy, consult with the company before getting your rental car.

Most credit cards also provide a form of coverage when driving a rental car, so you may not need to purchase temporary insurance in the first place. However, if you don’t have personal auto insurance coverage with Progressive and your credit card doesn’t have insurance, then buying temporary car insurance is your best bet.

You’re a Student Driver

If you’re a college student who only drives during summer and winter break, temporary car insurance is more affordable and convenient than staying on a long-term policy. You can get temporary car insurance from Progressive by suspending your policy when not in school – then reinstating it once you’re back. This simple process can save you up to $2,500 in insurance rates annually.

Some insurance providers, including Progressive, also offer attractive discounts for student drivers. In this case, you need to be on the policy full time to enjoy the cost-saving benefits without the hassle of taking them on and off the coverage when you get back to school. However, consult a Progressive insurance agent to see which option works best for you.

You Need Short-Term International Car Insurance

Progressive car insurance extends your current coverage to nearby countries like Canada, so you don’t need a temporary insurance coverage policy when going there. However, this coverage doesn’t extend to most places outside the U.S. You may need to add an international car insurance policy when going to certain countries.

It’s best to consult with the company’s representatives before crossing international borders. You should also take note of your host country’s requirements for foreign drivers’ insurance coverage. In most cases, you only need to purchase insurance from your rental car company. But if you’re planning to stay for extended periods, then you have to buy temporary car insurance.

You Need Temporary Car-Sharing Insurance

Ridesharing basically means converting your personal car into a commercial vehicle. Your current coverage may not cover you in such circumstances. If you’re driving for ridesharing companies like Uber and Lyft, check with your state’s laws and your insurer’s terms and conditions.

You’re Placing Your Car in Storage

Even in storage, your car is still at risk of damage and theft, which your comprehensive insurance policy may not cover. Some states also require you to maintain the car’s insurance while it’s parked, including the minimum level of property damage or bodily injury liability coverage.

This leaves you with three options: unregister your car and surrender your plates, maintain your current insurance coverage (which costs you money with minimal coverage) or get a temporary insurance policy.

You’re Adding Someone to Your Car Insurance Temporarily

If you’re lending your car to a friend or family member for a short one-time errand, you may want to add them to your temporary car insurance. Progressive covers temporary instances of car sharing in what’s known as a permissive user clause.

The coverage stands even if the person who borrowed your car has their own coverage. You may need to provide the other person’s personal information, such as their name, date of birth, social security number and more. Progressive also offers non-owner car insurance, for drivers getting their own coverage while using someone else’s car.

Is Progressive Temporary Car Insurance Worth It?

Although annual insurance premiums are a must-have, there are some situations where your coverage options don’t apply. In such cases, temporary car insurance may come in handy and save you a lot of time and money. Here are some of the most notable benefits of using Progressive temporary car insurance.

You Don’t Need To Adjust Your Policy

Adding another driver to an existing annual insurance policy is often a lengthy and tedious process. In most cases, it results in additional amendment fees and could drive up the cost of a policyholder’s existing insurance premium, depending on the new driver’s risk assessment.

If the person borrowing your car won’t need to use it for the whole remainder of your insurance premium’s validity, the costs and hassle involved in amending your existing premiums are simply not worth it. However, a temporary car insurance policy gives you all the coverage you need without having to go through the daunting amendment process. It’s also considerably cheaper.

Quick Purchase and Certification

At times, you may need added coverage for an emergency. Getting temporary car insurance is the best option since it can be processed in as little as 15 minutes. This is considerably faster than amending your current policy, which typically requires a 28-day pre-booking advance.

It Has No Impact on Your No-Claims Discount

Progressive offers you a lot of ways to save money. One example is its no-claims discount. The discount relies solely on the number of years you’ve driven without filing a claim. Typically, the longer you drive without filing a claim, the larger your discount and the lower your insurance premiums.

This can all be jeopardized simply by lending your car to a risky driver. If the person driving the car gets into an accident, it can inadvertently increase your insurance premiums. On the other hand, temporary car insurance acts as a standalone cover – so any claims made during the cover’s validity period don’t affect the vehicle owner’s premium rates.

How To Get Progressive Temporary Car Insurance

Progressive temporary car insurance coverage comes in one-year or six-month policies, so you can’t buy it on a daily or monthly basis. However, once you buy an annual or bi-annual policy, you can pay your premiums monthly or all in full. You can then request a refund when you’re done driving the car.

Either way, you can set a reminder so you don’t forget to renew or cancel your policy. If you’ve paid your insurance premium upfront and in full, be sure to request a refund once you’re done with the car. You can do this by simply contacting the company and obtaining a cancellation confirmation order.

Progressive doesn’t typically charge any cancellation fees. However, in some circumstances, the company may charge you 10% of your premium or a $50-to-$65 flat fee, depending on where you live.

Progressive Temporary Auto Insurance: Conclusion

Progressive car insurance can be an excellent option for drivers who want short-term coverage. However, it’s essential to remember that the insurer does not offer same-day or weekly insurance options like most other providers.

Progressive Temporary Car Insurance Alternatives

Many insurance companies offer temporary car insurance, but not all of them can serve your best interests. Finding the best one can be pretty daunting, and this is where you can make use of a comparison tool to look at free auto insurance quotes side by side. State Farm, GEICO and USAA are known for having some of the cheapest auto insurance in the nation.

State Farm: Best Customer Service

State Farm is known for its wide range of local agents, so customers have easy access to assistance whenever they file claims and get information on their policies. State Farm’s accessibility, attractive discounts and record of excellent customer service is why our experts have given it an overall rating of 4.6.

Keep reading: State Farm car insurance review

GEICO: Most Discount Options

Known for its incredibly low rates and attractive discounts, GEICO received a 4.4 score from our experts after careful and thorough scrutiny. Since GEICO has the most affordable rates in the industry, you’re more likely to get a good deal with its wide array of coverage options and discount opportunities. Like Progressive, GEICO also offers tons of discounts, including military discounts, safe driver discounts and multi-policy discounts.

Keep reading: GEICO car insurance review

USAA: Best for Military

USAA is arguably one of the best auto insurance providers for active military members, veterans and their families. With an overall rating of 4.5 from our experts, the company ranks pretty high in affordable premiums, customer service and claims processing. It also offers impressive discounts like good student discounts, newer vehicle discounts and multi-policy discounts, among others.

Keep reading: USAA car insurance review

Progressive Temporary Car Insurance: FAQ

Below are frequently asked questions about Progressive temporary car insurance:

Does temporary car insurance exist?

An actual temporary car insurance policy does not exist. However, you can get insurance temporarily by only using it for as long as you need and canceling when necessary. Insurance companies will expect you to pay for the full six or one-year policy term. With Progressive, you can cancel your policy any time and get a refund.

Why would you need temporary auto insurance?

Some car owners need temporary auto insurance if they don’t drive their cars often, only drive their cars at certain times a year, are renting a car and need more coverage or are putting their car in storage.

Can I get temporary car insurance on a friend’s car?

You can get temporary car insurance on a friend’s car. If you borrow a car and the owner’s policy does not cover you using it, you can get Progressive temporary car insurance to cover the car for the limited time you’re using it.

Does temporary car insurance cover drivers with DUIs?

DUIs and traffic tickets aren’t typically an issue with making sure your car insurance is temporary. However, an insurance company may refuse to give you coverage if you have past convictions and harsh driving penalties. The company may also increase the rates on your premiums.

Can I use temporary car insurance to cover an impounded car?

You’ll typically need temporary insurance coverage valid for a minimum of 30 days to cover an impounded or seized car. That said, some insurance companies may provide the minimum length of coverage, as long as you meet the state’s and company’s requirements.

When would you need temporary auto insurance?

There are several scenarios where purchasing Progressive temporary car insurance would be beneficial, including the following situations:

– You’re a college student who does not drive regularly.

– You’ll be staying with a family member or friend and borrowing their car.

– You own a vehicle that is only driven seasonally.

– You bought a car that you’re planning to resell soon.

Is temporary car insurance legit?

While temporary car insurance isn’t typically offered by major insurers like Progressive, options are still available if you’ll only be driving temporarily. If you own your vehicle, you can buy a six-month policy, cancel when you’re done driving, and avoid paying for the months you don’t drive.

What is temporary insurance coverage?

Temporary insurance can provide coverage for your car for a short amount of time. For example, it may provide you with coverage for three months instead of six.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.

*Data accurate at time of publication.