Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

We rate Progressive car insurance a 4.5 out of 5.0 and name it Best for Accident-Prone Drivers in 2024 due to its low rates and extensive coverage offerings.

Progressive is one of the most well-known auto insurance companies in the U.S. But we wanted to see how the provider measured up against the country’s best car insurance and cheapest car insurance companies. So we took a deep dive into the company’s policies, rates, industry reputation, and customer ratings for this Progressive car insurance review.

Progressive Insurance Reviews

We gave Progressive a 4.5 out of 5.0 rating due to its industry standing, availability, coverage, affordability, customer service, and online experience. Since Progressive provides affordable rates for high-risk drivers and several unique car insurance coverage offerings, we named it “Best for Accident-Prone Drivers” in 2024.

| Review Category | Ratings Score |

| Industry Standing | 4.8 |

| Availability | 5.0 |

| Coverage | 4.8 |

| Affordability | 3.9 |

| Customer Service | 4.1 |

| Online Experience | 4.9 |

| Overall Rating | 4.5 |

Is Progressive a Reputable Company?

Yes, Progressive is a reputable insurance company for drivers who want an array of coverage options at affordable rates. After researching the best car insurance companies in the industry, we found that Progressive tends to be one of the most affordable insurers for high-risk drivers and those with a good driving record, making it a great car insurance company overall.

Pros and Cons of Progressive Auto Insurance

Here’s a look into the pros and cons of Progressive car insurance:

| Progressive Pros | Progressive Cons |

|---|---|

| Affordable rates for drivers with a DUI | Lower than average rating in the J.D. Power Shopping Study |

| Deductible savings program | Higher premiums that many competitors |

| Superior AM Best rating |

Progressive Insurance Ratings

Progressive has very solid ratings within the insurance industry. The company earned an A+ financial strength rating from AM Best, indicating a strong ability to pay out insurance claims. and the company received an A+ rating from the Better Business Bureau (BBB).

Progressive Auto Insurance Customer Satisfaction

In 2022, our editorial team conducted a nationwide car insurance survey polling nearly 7,000 people to find out their overall satisfaction with their car insurance provider. Of those who participated, 17% reported they had a Progressive car insurance policy. The overall customer satisfaction rating given to Progressive by those respondents was 4.1 out of 5.0, just below the insurance company industry average.

About Progressive

Since opening its doors in 1937, Progressive has become one of the biggest car insurance companies in the U.S. The company wrote more than $35 billion in insurance premiums in 2021, according to the National Association of Insurance Commissioners (NAIC).

The company has been an innovative force in the insurance industry. In 1997, Progressive auto insurance was the first auto policy that was available for purchase over the internet. It was also the first insurer to offer usage-based insurance, beginning in 2008.

Coverage Options

Progressive offers the standard types of auto insurance coverage as well as extra coverage options drivers may not easily find elsewhere.

Progressive car insurance plans include:

- Bodily injury liability coverage

- Property damage liability coverage

- Comprehensive coverage

- Collision coverage

- Uninsured/underinsured motorist coverage

- Medical payments (MedPay) coverage

Additional Policy Add-Ons

Progressive also offers the following car insurance coverage add-ons:

- Rental car reimbursement

- Loan/lease payoff

- Complementary pet coverage

- Custom parts and equipment value

- Roadside assistance

- Rideshare coverage

- Accident forgiveness

Average Rates

According to our Progressive rate estimates, the company is one of the most affordable providers overall. Good drivers can find full coverage rates at around $136 per month or $1,628 annually, which is cheaper than the national average of $1,983.

Cost Factors

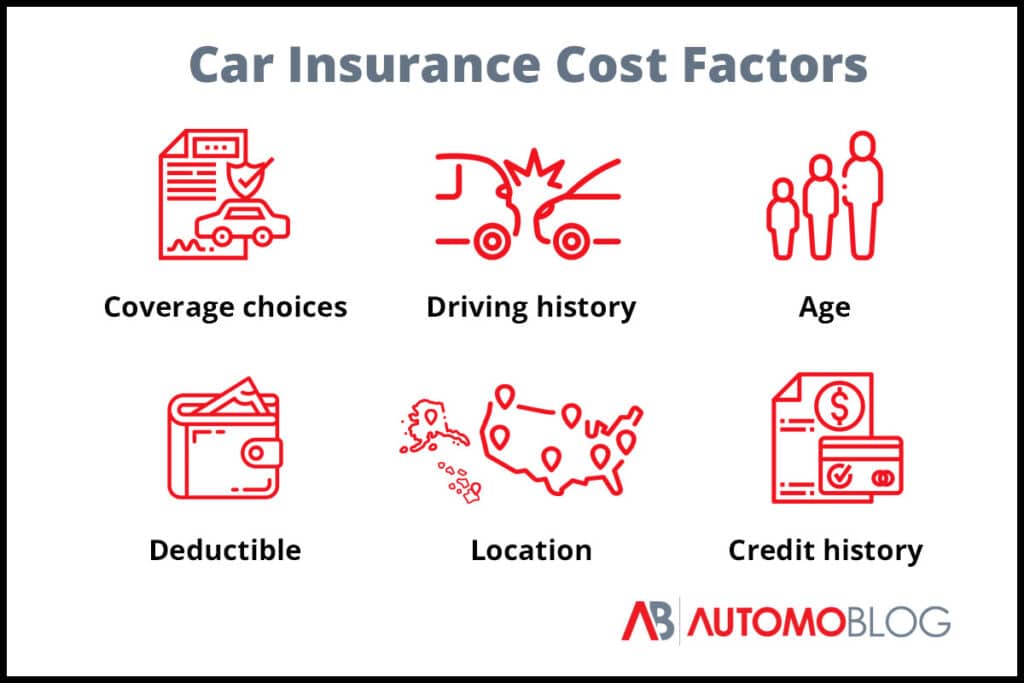

There’s more to your car insurance rates than where you live. Like all providers, Progressive determines your rates based on a few different variables about you and your vehicle.

There’s more to your car insurance rates than where you live. Like all providers, Progressive determines your rates based on a few different variables about you and your vehicle.

Here are some of the factors Progressive uses to calculate your rates:

- Coverage options: Policies that only satisfy your state’s minimum insurance requirements will be the least expensive. Additional coverage will add to your premiums.

- Coverage limits: The amount of auto insurance coverage you have in your policy is also a major factor. Again, the state minimums will be your cheapest option. But they’ll also leave you exposed to financial risk.

- Deductible: You can also choose your deductible. But the lower that deductible is, the higher your premium will be.

- Driving record: Drivers with clean records get the lowest rates. If you have any at-fault accidents or violations, you’ll pay more for coverage.

- Age: Teen drivers pay the highest rates for car insurance. Seniors also tend to pay higher rates than middle-aged drivers.

- Credit history: The higher your credit score is, the lower your rates will be in most states. But some states have made it illegal to adjust your rates based on your credit report.

- Location: While it’s true that rates vary between states, they also vary within states. Drivers in rural ZIP codes tend to pay less than those that live in urban areas.

Available Discounts

We found that Progressive offers some of the best rates for teens, people with DUIs, and other drivers in the high-risk category. However, the company also offers discounts to bring those costs down even further.

Here are some of the discounts Progressive offers to help you save money:

- Multi-car discount

- Paid in full discount

- Sign online discount

- Teen driver discount

- Multi-policy discount

- Safe driver discount

- Homeowner discount

- Online quote discount

- Good student discount

- Distant student discount

- Paperless billing discount

- Automatic payments discount

- Continuous insurance discount

Progressive Snapshot®

Progressive is one of many insurance companies that offers a telematics program. Snapshot uses a mobile app to monitor your driving habits. The program rewards you for safe driving habits by lowering your premiums.

However, it can also raise your rates if you drive in ways that the company considers unsafe. And from Progressive insurance reviews at the BBB website, it appears that it did for at least a few drivers. Several reviewers said that the tracking is overly sensitive and unfair.

Progressive Deductible Savings Bank®

The deductible savings bank is a unique program from Progressive. Every time you finish out a six-month policy term without any violations or accidents, you’ll get $50 put into an account. You can use these funds towards your next deductible payment.

Progressive Mobile App

Technology has grown in importance as many consumers manage a greater number of accounts through apps and online portals. Progressive’s mobile app is a one-stop shop for making claims, checking your auto insurance policy, and getting assistance in emergency situations.

With the app, you can:

- Report a claim

- Get a free quote

- View coverage for all drivers

- Request roadside assistance

- Shop for Progressive products

- Send photos of vehicle damage

- Get status updates on claims and repairs

- Pay bills using a credit/debit card or checking account

Additional highlights include the ability to use Google or Apple Pay and offline viewing of your car insurance ID card. The app is secure and encrypts all personal information for user safety.

Progressive Car Insurance Review: Conclusion

Based on our research and Progressive insurance reviews, we found Progressive offers the best coverage for riskier drivers, including teens and students. This is likely to be a major benefit for many households.

Progressive also offers an excellent online experience with easy enrollment and account management. However, many customers have only average claims experiences and therefore may not receive the coverage they expected.

Progressive Competitors: Recommended Providers

Progressive may be a great option for some drivers, but others may find better rates or a better customer experience elsewhere. Regardless of how you feel about Progressive, it’s always a good idea to get car insurance quotes from multiple providers and compare to see which one offers the best combination of rates and coverage for you. Our editors suggest considering two of the top performers in our latest auto insurance study.

GEICO: Most Discount Options

During our most recent auto insurance study, GEICO consistently offered some of the lowest rate estimates in most places. On top of that, the company also features one of the widest selections of discounts among any provider we examined. That means that anyone looking for cheap coverage from a reputable provider will want to consider GEICO as an option.

Read more: Geico car insurance review

State Farm: Best Customer Experience

State Farm is the nation’s largest insurer and in our most recent industry-wide car insurance study it ranked as Best Customer Experience, earning the highest total score of any provider. While a strong portfolio of additional coverage options and generally competitive rates make State Farm a good option for most drivers, the provider is an especially attractive option for households with younger drivers. That’s because State Farm offers a number of discounts to help bring down the cost of coverage for younger drivers and especially students.

Read more: State Farm car insurance review

Progressive Auto Insurance: FAQ

Below are frequently asked questions about Progressive car insurance reviews.

Does Progressive have a good rating?

Yes, Progressive has a good rating. The company received an overall score of 4.5 out of 5.0 from our editorial team for its strong customer service and reviews, affordable coverage, and range of policy options.

Who beats Progressive Insurance?

In our study of the best car insurance companies in the industry, we found that State Farm was the Best Customer Experience Provider for 2024. We gave the company a 4.6 out of 5.0 rating for its affordability, customer service reputation, and coverage options for drivers.

What bank does Progressive Insurance use?

Progressive uses Commerce Bank to pay its claims. This arrangement allows the company to pay out claims in real-time to debit cards or prepaid cards, rather than have customers wait for a check in the mail.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.