Knowing the difference between the MSRP and the invoice price will help you save money on a new vehicle. The quick explanation is that MSRP is for consumers, and the invoice price is for dealers. In this guide, we will go through both and share some best practices that will help you ultimately pay less money for a new vehicle.

MSRP vs. Invoice Price

To help visualize what this MSRP vs. invoice concept looks like, think in terms of higher and lower, and easy and not so easy. This is important because it impacts a dealer’s profit margin and your final cost for a new car. Let’s start first with a quick definition of each.

What Is MSRP?

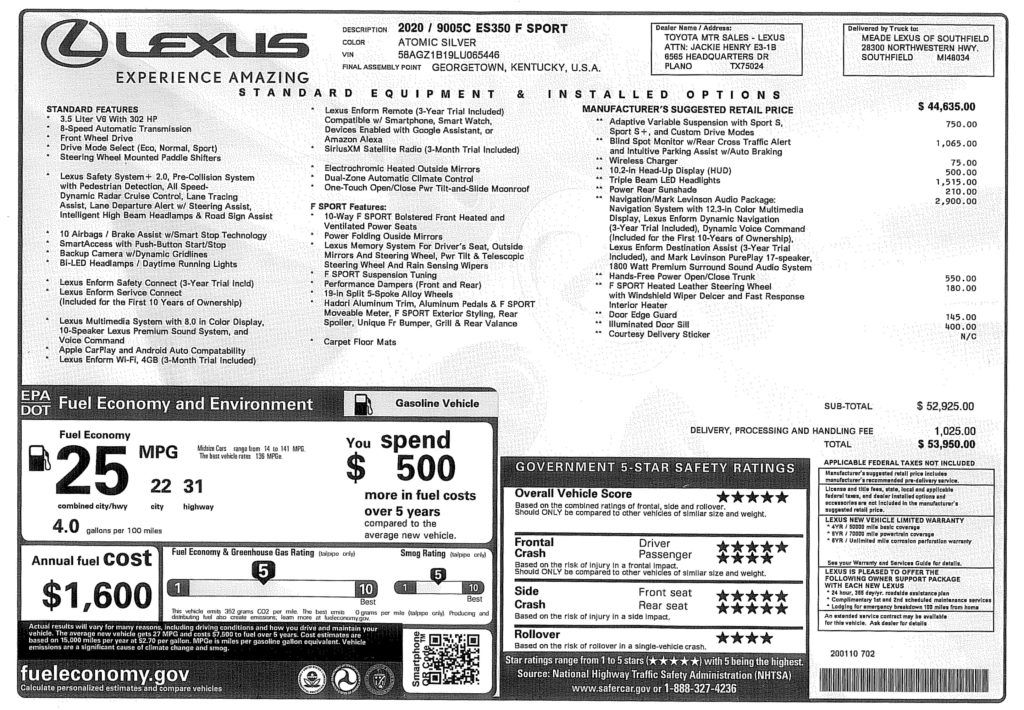

MSRP is the acronym for Manufacturer’s Suggested Retail Price. Sometimes referred to as the “retail price” or “sticker price,” the MSRP is the purchase price as suggested by the automaker. The Manufacturer’s Suggested Retail Price is easy to find. It will be readily available on the vehicle’s window sticker (maybe even boxed and highlighted), on a dealer’s website, or listed in almost every car review on the internet.

Despite being easy to find, the sticker price is one of the higher figures (strictly in terms of dollar figures, not actual costs) you will see during the car buying process.

What Does The MSRP Include?

The MSRP includes the base price for the new car, extra factory options or packages, dealer add-ons (if applicable), and the destination charge (which can vary by state). It does not include rebates, tax, title, license, or any other fees.

Can You Buy a New Car for Less Than MSRP?

Yes, and you should never purchase the average new car for the exact MSRP. Although they will vary by vehicle, region, and time of year, manufacturer rebates (sometimes called factory incentives) are available when buying a new car. You may even qualify for additional rebates, like military service or if you are a college student. You can check online, through an automaker’s website, what the current rebates and incentives are. Every rebate you are eligible for is subtracted from the MSRP.

There is a tendency to “negotiate down” from MSRP, but you are better to negotiate up from the invoice prices. We will explain more in a moment.

What Is The Invoice Price?

Generally speaking, the invoice price is what the dealer pays for the new cars on its lot. When a manufacturer ships a vehicle from the factory, the dealership is handed a bill (or an invoice). Invoice prices are lower than the MSRP, but not as easy to find!

We have a caveat to add but will cover it at the end. This idea of the invoice price vs. dealer cost can be tricky. For example, a common question is how much lower is the invoice price than the MSRP? Or is the invoice price actually a good deal? The answers can and do vary, and every new vehicle is different in how it’s priced.

Our goal here – and your end goal before visiting a dealership – is to get as much information as possible when it comes to the amount you will pay for a new car. For now, let’s focus on the invoice price and what it means in the consumer world, not the dealership world. For you, the invoice price generally represents the lowest possible number as a starting point for negotiations.

Why Is Invoice Pricing Important?

In the typical car sales environment, the odds are stacked against you. Dealers sell vehicles every day, whereas you may only buy one every few years. They have their sales process down, they know how to negotiate, and they know how much money is on the table with every vehicle on their lot. That said, it’s crucial to have the ball in your court when you negotiate.

The common strategy is to negotiate down from the MSRP. But remember where MSRP falls at the “higher and easy” end of the spectrum. If you start here, you are at a disadvantage. How the typical dealership pays its sales consultants is part of the reason why.

If they are paid on the gross amount of each vehicle they sell, there is an incentive to keep you at the higher end of the pricing scale or closer to the MSRP. The closer to the MSRP they sell the vehicle, the higher the dealer’s profit margin and the bigger the commission check. And this starts the “unspoken battle” that causes stress for buyers. The dealer is trying to get you to pay more for the vehicle, and you are trying to pay less!

Invoice prices are important because knowing what they are will allow you to negotiate up rather than down. Rather than starting high at the MSRP, which is of more benefit to the dealership, you are beginning at a lower point with the invoice price (or closer to what the dealer paid for the vehicle), which is better for you.

How Do You Find Invoice Pricing?

There are two useful methods. You can do one before you contact the dealer, and the other is for when you are talking with them.

Online Search Tools

Through Automoblog, we offer this free and easy search tool* that helps you find the invoice price. You can search from your home and see which dealers in your area offer the best discounts and incentives. Knowing what dealers are offering will play in your favor when negotiating.

We also trust Rydeshopper, a neutral third-party vehicle search site*. Like our tool, you can use Rydeshopper for free to see dealer inventory in your area, along with contact info and pricing.

Asking Nicely

One way is to simply ask for the invoice price of the new car you are looking at. If you are nervous about this, try phrasing it like this:

“I understand that invoice pricing might be available. May I ask what that is on this particular vehicle? I have read good things about this manufacturer (or make/model) and about your dealership online. I would be interested in possibly making a deal, but I want to ask for the invoice pricing first.”

With this approach, you are turning the sales game back onto the dealership. You are subtly suggesting that by providing the invoice price (the amount that is the lowest starting point for negotiation and the hardest to come by), they will live up to their good name. When you negotiate, it never hurts to have a few lines like this in your back pocket.

Here is another one you can try:

“I am looking at a few different vehicles at different dealers right now. Based on my research online, I understand that a dealer invoice price might be available? If so, may I see it with regard to this particular car? If not, that’s okay – but I want to get an idea of what the costs are and what I may have to pay after all the factory rebates, dealer incentives, and fees are applied.”

This line implies that while seeing the dealer invoice is important, it’s also not the end of the world. Suppose the invoice price is, for whatever reason, not available through this particular dealership. In that case, it still communicates that you are shopping around and will only consider a fair “out the door” price.

While shopping for a new car, it’s best to think about the final price, instead of things like the monthly payment. If you consider the car buying process as a whole entity, it will lessen the chances of unexpected fees popping up at the last minute.

One Last Consideration: Dealer Cost

This goes back to the caveat we mentioned above. There is a difference between the invoice price and dealer cost when it comes to new vehicles. In the general sense, one can reasonably say the invoice price means that’s the price the dealer will pay for the car in question. However, the true amount the dealer pays is still probably lower than the invoice price.

The reason has to do with how a dealership operates internally. You can find more information in this helpful article from NADA. That article dives deeper into dealer cost and other important terms like dealer holdback and dealer incentives. Everything they cover is good supplemental information to have as you are shopping from dealer to dealer.

Quick Recap & Other Tips

- New car prices ebb and flow with the calendar year.

- Seek out all manufacturer rebates and dealer incentives.

- Make sure to ask the dealer about any other additional fees.

- When it comes to invoice pricing, use the search tools above, or ask the dealer politely.

Carl Anthony is Managing Editor of Automoblog and a member of the Midwest Automotive Media Association and the Society of Automotive Historians. He serves on the board of directors for the Ally Jolie Baldwin Foundation, is a past president of Detroit Working Writers, and a loyal Detroit Lions fan.

*Automoblog and its partners may be compensated when you visit this link.