Affiliate Disclosure: Automoblog and its partners may earn a commission when you use the services or tools provided on site. These commissions come to us at no additional cost to you. See our Privacy Policy to learn more.

The window for public comment on the proposed car dealer regulations by the Federal Trade Commission (FTC) officially closed on Monday, September 12. The proposed regulations target some industry practices that have come under increasing scrutiny in recent years. As they are currently written, these regulations could have a substantial impact on the way car dealerships do business.

The FTC Received a Massive Number of Complaints About Car Dealerships in Recent Years

The new regulations appear to come in response to a high number of complaints to the FTC about car dealerships. According to the FTC, the organization received more than 100,000 complaints related to car dealers in each of the last three years.

In its public proposal, the organization states that the top 10 most common complaints they receive each year are all related to new and used motor vehicle sales, financing, service, warranties, rentals, leasing, and complaints about motor vehicle transactions.

Many of these complaints are related to practices that have become commonplace in the auto industry. The organization describes the following scenario as having “summed up these issues.”

“The consumer purchased a $2,000 service contract that the dealer falsely said was free, and a $900 GAP [guaranteed asset protection] insurance contract that the dealer falsely said was mandatory, and learned about these purchases during the study interview.”

The proposal also includes a quote from the aforementioned consumer about their experience that may sound familiar to car buyers.

“I feel I’ve been taken advantage of, to be honest with you,” said the consumer. “Even though I thought that I was getting a great deal with the interest rate … I now see that they’re also very sneaky about putting stuff on your paperwork. They only let you skim through the paperwork that you have to sign and they just kind of tell you what it is. This is this, this is that, this is this, and then you just sign it away. You’re so tired, you’re so worn down, you don’t want to be there no more.”

New FTC Regulations Would Introduce Major Changes

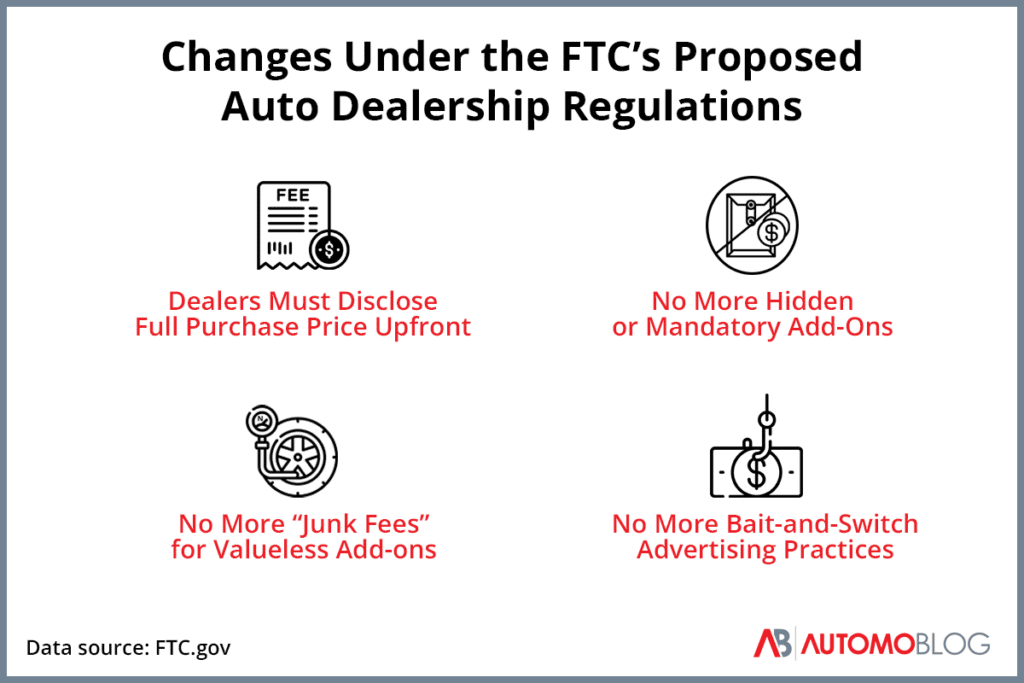

The organization’s proposed regulations directly target many of the practices that a consumer might see as “sneaky.” As written, new guidelines would offer more transparency for buyers and limit what dealers can sell to them and how they can sell those products and services.

Dealerships Will Need to Disclose Full Price Up Front

Since the onset of the chip shortage and other supply chain issues, dealerships selling cars for far above the manufacturer’s suggested retail price (MSRP) has become an increasingly common practice. But even before this, dealers waiting to reveal certain fees and additional costs until later in the buying process was not uncommon.

Under the proposal, dealers would be required to provide buyers with a true “offering price.” This price would be required to reflect the full price that a buyer would pay, only leaving out taxes and other required government fees.

This section of the proposal also mandates that dealers provide their customers with relevant information about their financing terms. Such a change would offer more clarity to buyers, especially the 70% who use indirect in-house dealership financing to purchase a car.

No More Fraudulent “Junk Fees”

Another way dealerships have been able to make extra profit is by charging for additional products that offer little or no value to the buyer. One common example is charging a premium to fill tires with nitrogen rather than “regular” air, but not using gas with a higher concentration of nitrogen than “regular” air. The proposed regulations would prohibit these kinds of fraudulent fees.

No More Surprise Fees and Add-Ons

The proposed regulations target dealer add-ons from an additional angle. The FTC received many complaints about dealers adding equipment, warranties, or other services without asking, increasing the purchase price from what was advertised or offered up front.

Under the new rules, dealers would be required to get written consent from buyers to include additional products or services. They would also be required to provide customers with a final purchase price without any of these add-ons.

An End to Bait-and-Switch Tactics

One practice that has become increasingly common is dealers misrepresenting the vehicles they have for sale or how much they are selling them for. This typically comes in the form of either advertising a vehicle that is not available, or advertising a price that isn’t actually available.

As the FTC puts it, “this deal deception can include the cost of a vehicle or the terms of financing, the cost of any add-on products or services, whether financing terms are for a lease, the availability of any discounts or rebates, the actual availability of the vehicles being advertised, and whether a financing deal has been finalized, among other areas. Once in the door or on the hook, consumers face the fallout of false promises that don’t pan out.”

The proposal would prohibit dealerships from any such practices. They would no longer be allowed to bring potential buyers in with offers that aren’t actually available to them.

Auto Dealers Have Pushed Back Against the Proposed Regulations

The FTC’s proposed regulations have been met with public pushback from auto dealers and organizations that represent them. In July, the National Automobile Dealers Association (NADA) filed a request with the FTC to extend the public comment period.

Signed by NADA president Paul D. Metrey, the request maintained that the 60-day window for comment provided by the FTC was insufficient. It also said that the new regulations are “unprecedented in scope and would affect tens of millions of consumer transactions annually.”

The FTC flatly rejected the request on August 23, refusing to issue an extension. In an online statement, the organization noted that the public was actually given an additional 20 days to comment, recognizing the time between when it announced its plans on June 23 and when it officially published them with the Federal Register on July 13.

In its statement about its refusal to issue an extension, the FTC said that “members of the public will have had 80 days to review the proposed rule.”

Dealers Have a Lot to Lose Under the New Regulations

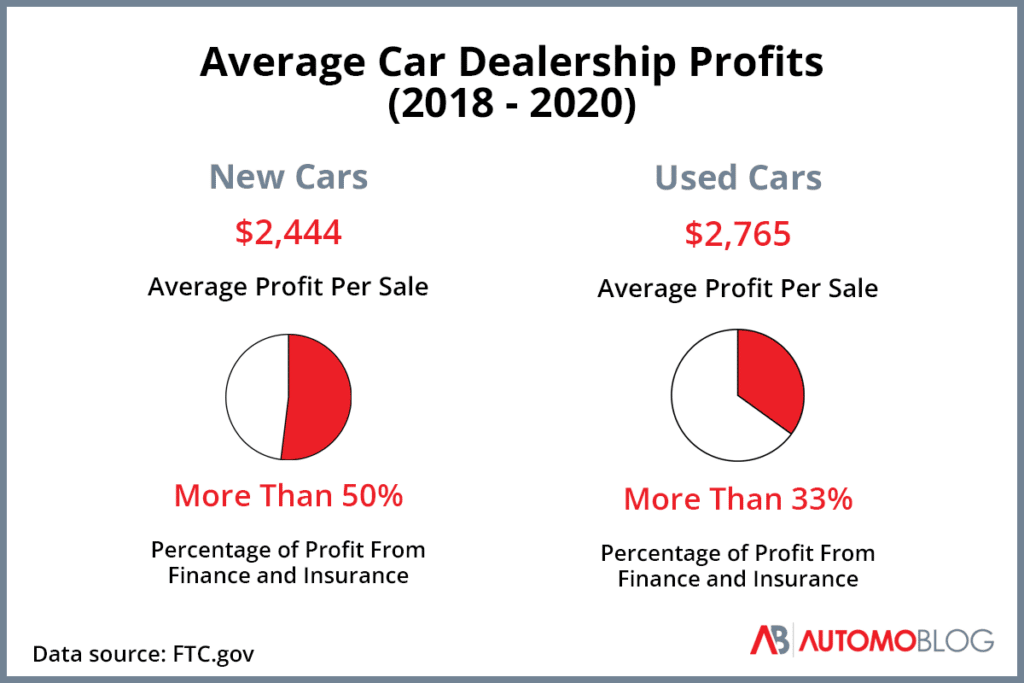

Pushback from NADA and others was to be expected. Add-ons such as warranties and financing that may be unclear to consumers have become major profit generators for dealerships.

According to FTC data, dealerships averaged around $2,444 in profit per new vehicle each sale between 2018 and 2020. More than half of that profit came from financing and insurance. Among used vehicles, dealerships averaged around $2,765 in profit per sale, with more than a third of that coming from financing and insurance.

Buyers are also increasingly opting for add-ons. According to data from NADA, 46% of car buyers in 2021 purchased an extended warranty, a significant increase over the 40% who did so in 2013.

These new profit sectors have become especially important as profit margins on new vehicle sales have slid in recent years. According to J.D. Power, dealership profit margins dropped to 1.2% per vehicle in 2021 — the average margin was 2.1% in 2014.

What the New FTC Regulations Could Mean For Car Buyers

If the proposed regulations become actual regulations, car buyers will likely have much more information about their purchase easily available. This could translate into buyers being able to make more informed decisions about their purchases, as well as understanding more of what they are being charged for. Overall, the new regulations should result in buyers having increased agency over the process.

That doesn’t mean that car buyers can afford to let their guards down — the new rules haven’t taken effect just yet. Once the new regulations are in place, exactly how they are enforced will be the next important question.

Even before new regulations take effect, you can still reach out to the FTC if you feel you’ve been a victim of deceptive practices at a car dealership. The organization has a form you can use to file a complaint or report fraud online.