Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

- The country’s average rate for full-coverage car insurance is $1,983 per year, or $165 per month.

- Premiums vary based on your driver profile and other factors.

- Maine, Ohio, and Vermont have the cheapest full-coverage car insurance on average.

- Michigan, Connecticut, and Florida have the most expensive full-coverage car insurance on average.

In the U.S., the average cost of car insurance is $1,983 per year for full coverage and around $766 per year for minimum coverage. However, actual costs vary by location, driving record, and other factors.

Our team collected dozens of estimates for different states, ages, and risk factors from the best car insurance companies in the country. While your rates will vary, the average car insurance rates for drivers in your situation can provide a solid benchmark for comparison. You’ll find those sample rates, information about how premiums are calculated, and a few recommended providers to help you shop for car insurance.

How Much Is Car Insurance?

Americans pay an average of $1,983 per year for full coverage car insurance, which comes out to just over $165 per month. The average cost of a minimum coverage policy in the U.S. is $766 per year or $64 per month. However, insurance rates vary based on several variables such as your location, driving record, and more.

These averages and the other rate estimates you’ll find throughout this article are based on our standard profile of a 40-year-old driver with a clean driving record and good credit unless otherwise noted. Estimates are also for full coverage rates unless stated differently.

Average Cost of Car Insurance by State

Where you live strongly influences how much you’ll spend on auto insurance. Some states have liability-only requirements, while others require more coverage, which can affect average costs. Local risk factors like climate, population, and crime rates also play a role.

In the following table, you’ll find the average car insurance prices for each state and the District of Columbia.

| State | Average Liability Coverage | Average Full Coverage |

| Alabama | $559 | $1,717 |

| Alaska | $642 | $1,629 |

| Arizona | $596 | $1,680 |

| Arkansas | $498 | $1,711 |

| California | $449 | $1,293 |

| Colorado | $641 | $2,177 |

| Connecticut | $1,070 | $2,229 |

| Delaware | $1,345 | $3,011 |

| District of Columbia | $632 | $1,795 |

| Florida | $1,707 | $3,991 |

| Georgia | $816 | $1,850 |

| Hawaii | $1,196 | $3,131 |

| Idaho | $372 | $1,035 |

| Illinois | $624 | $1,859 |

| Indiana | $506 | $1,407 |

| Iowa | $339 | $1,424 |

| Kansas | $585 | $1,681 |

| Kentucky | $628 | $1,803 |

| Louisiana | $1,139 | $3,429 |

| Maine | $427 | $1,062 |

| Maryland | $1,561 | $2,699 |

| Massachusetts | $530 | $1,836 |

| Michigan | $1,638 | $3,642 |

| Minnesota | $845 | $2,272 |

| Mississippi | $542 | $1,549 |

| Missouri | $540 | $1,758 |

| Montana | $485 | $1,773 |

| Nebraska | $427 | $1,483 |

| Nevada | $1,323 | $3,180 |

| New Hampshire | $514 | $1,244 |

| New Jersey | $1,371 | $2,345 |

| New Mexico | $636 | $2,134 |

| New York | $1,886 | $3,371 |

| North Carolina | $567 | $1,527 |

| North Dakota | $428 | $1,326 |

| Ohio | $632 | $1,408 |

| Oklahoma | $635 | $2,006 |

| Oregon | $818 | $1,497 |

| Pennsylvania | $860 | $3,255 |

| Rhode Island | $1,188 | $2,440 |

| South Carolina | $816 | $1,775 |

| South Dakota | $353 | $2,198 |

| Tennessee | $508 | $1,495 |

| Texas | $825 | $2,246 |

| Utah | $976 | $1,988 |

| Vermont | $318 | $978 |

| Virginia | $597 | $1,390 |

| Washington | $598 | $1,487 |

| West Virginia | $496 | $1,595 |

| Wisconsin | $617 | $1,962 |

| Wyoming | $329 | $1,479 |

States With the Lowest Average Car Insurance Cost

The following states tend to have the nation’s lowest average cost of full-coverage car insurance policies:

- Vermont: $978 per year — 51% below the national average

- Idaho: $1,035 per year — 48% below the national average

- Maine: $1,062 per year — 47% below the national average

- New Hampshire: $1,244 per year — 37% below the national average

- California: $1,293 per year — 35% below the national average

- North Dakota: $1,326 per year — 33% below the national average

- Virginia: $1,390 per year — 30% below the national average

- Indiana: $1,407 per year — 29% below the national average

- Ohio: $1,408 per year — 29% below the national average

- Iowa: $1,424 per year — 28% below the national average

States With the Highest Average Car Insurance Cost

The states below often have the most expensive average full coverage car insurance premiums in the U.S:

- Florida: $3,991 per year — 101% above the national average

- Michigan: $3,642 per year — 84% above the national average

- Louisiana: $3,429 per year — 73% above the national average

- New York: $3,371 per year — 70% above the national average

- Pennsylvania: $3,255 per year — 64% above the national average

- Nevada: $3,180 per year — 60% above the national average

- Hawaii: $3,131 per year— 58% above the national average

- Delaware: $3,011 per year — 52% above the national average

- Maryland: $2,699 per year — 36% above the national average

- Rhode Island: $2,440 per year — 23% above the national average

Cheapest Car Insurance Provider by State

Auto insurance rates between states due to varying regulations and risk factors. In the table below, you’ll find the cheapest auto insurance providers for each state and their average rates.

Car Insurance Cost by Provider

Many of the top providers in the industry offer cheap car insurance in comparison to national averages. The table below shows the cheapest full coverage rates for our standard driver profile.

| Car Insurance Company | Monthly Cost Estimate | Annual Cost Estimate |

| *USAA | $98 | $1,179 |

| Erie Insurance | $121 | $1,456 |

| Auto-Owners | $124 | $1,491 |

| Nationwide | $130 | $1,556 |

| Progressive | $136 | $1,628 |

| Travelers | $137 | $1,643 |

| GEICO | $148 | $1,779 |

| State Farm | $156 | $1,872 |

| American Family | $178 | $2,131 |

| Kemper | $195 | $2,338 |

| Farmers | $227 | $2,722 |

| Allstate | $231 | $2,768 |

Generally, the cheapest auto insurance providers available across the entire country are USAA, GEICO, State Farm, and Progressive. Drivers who live in regions with Erie Insurance and Auto-Owners Insurance may want to consider car insurance quotes from them as well.

Car Insurance Cost by Age

One of the most significant factors impacting car insurance premiums is age. In fact, teen drivers and those in their early 20s can pay hundreds of dollars more for car insurance than older, experienced drivers. You’ll find the average rates for several ages in the table below.

| Age | Average Monthly Cost of Car Insurance | Average Annual Cost of Car Insurance |

| 16 | $680 | $8,160 |

| 17* | $468 | $5,612 |

| 18* | $413 | $4,958 |

| 19* | $309 | $3,708 |

| 20 | $313 | $3,752 |

| 25* | $168 | $2,019 |

| 30 | $171 | $2,047 |

| 35* | $149 | $1,785 |

| 40 | $165 | $1,983 |

| 45* | $144 | $1,730 |

| 50 | $158 | $1,895 |

| 55* | $134 | $1,609 |

| 65* | $137 | $1,648 |

| 75* | $159 | $1,912 |

Cost of Car Insurance for Young Drivers

As mentioned above, most young motorists and teen drivers generally spend more than the national average for full coverage car insurance. Younger drivers may want to check with GEICO and USAA, who offer some of the lowest rates for their age group.

| Car Insurance Company | Monthly Rate Estimate | Annual Rate Estimate |

| Auto-Owners | $281 | $3,368 |

| Erie Insurance | $370 | $4,440 |

| *USAA | $414 | $4,972 |

| State Farm | $431 | $5,167 |

| Nationwide | $472 | $5,662 |

| American Family | $483 | $5,797 |

| GEICO | $533 | $6,394 |

| Travelers | $798 | $9,571 |

| Kemper | $839 | $10,068 |

| Allstate | $1,042 | $12,502 |

| Progressive | $1,057 | $12,679 |

| Farmers | $1,230 | $14,765 |

Average Cost of Car Insurance by Risk Factor

Other pieces of information about you and your driving history play big roles in the cost of your premiums. Every insurer weighs certain risk factors a little differently from one another. In the following section, you’ll find rate estimates from top providers for a few different risk categories.

Average Cost of Auto Insurance for Good Drivers

Good drivers with a clean record get access to the lowest auto insurance premiums. These drivers will find affordable coverage in many places, but the average rates from USAA, State Farm, and GEICO are among the lowest for nationally available providers. Regional providers offer affordable rates as well, such as Erie Insurance or Auto-Owners.

| Car Insurance Company | Monthly Cost Estimate | Annual Cost Estimate |

| USAA | $98 | $1,179 |

| Erie Insurance | $121 | $1,456 |

| Auto-Owners | $124 | $1,491 |

| Nationwide | $130 | $1,556 |

| Progressive | $136 | $1,628 |

| Travelers | $137 | $1,643 |

| GEICO | $148 | $1,779 |

| State Farm | $156 | $1,872 |

| American Family | $178 | $2,131 |

| Kemper | $195 | $2,338 |

| Farmers | $227 | $2,722 |

| Allstate | $231 | $2,768 |

Average Cost of Auto Insurance for Drivers With a Recent Accident

A recent at-fault accident typically increases the cost of insurance. Both USAA and State Farm offer estimates lower than the average national rate.

| Car Insurance Company | Monthly Rate Estimate | Annual Rate Estimate |

| USAA | $142 | $1,709 |

| Erie Insurance | $164 | $1,963 |

| Auto-Owners | $172 | $2,058 |

| State Farm | $185 | $2,219 |

| Travelers | $189 | $2,267 |

| Nationwide | $205 | $2,463 |

| Progressive | $213 | $2,554 |

| American Family | $229 | $2,743 |

| GEICO | $259 | $3,103 |

| Kemper | $315 | $3,780 |

| Farmers | $346 | $4,157 |

| Allstate | $355 | $4,256 |

Average Cost of Auto Insurance for Drivers With a Recent DUI

A DUI on your driving record is a serious infraction and can cause your rates to go up significantly. However, State Farm, Erie Insurance, and Progressive tend to offer relatively affordable rates for drivers with DUIs.

| Car Insurance Company | Monthly Rate Estimate | Annual Rate Estimate |

| Progressive | $176 | $2,107 |

| USAA | $184 | $2,209 |

| State Farm | $200 | $2,401 |

| Erie Insurance | $201 | $2,409 |

| Travelers | $207 | $2,489 |

| Auto-Owners | $255 | $3,054 |

| American Family | $271 | $3,251 |

| Nationwide | $296 | $3,551 |

| Allstate | $324 | $3,892 |

| Kemper | $337 | $4,044 |

| GEICO | $364 | $4,373 |

| Farmers | $386 | $4,634 |

Average Cost of Auto Insurance for Drivers With Poor Credit

Lawmakers in California, Hawaii, Massachusetts, and Michigan have outlawed the practice of using credit scores as a factor in car insurance premiums. But in every other state, drivers with poor credit tend to pay substantially higher premiums than drivers with good credit. Drivers with lower credit scores tend to find the best rates at USAA and Nationwide.

| Car Insurance Company | Monthly Rate Estimate | Annual Rate Estimate |

| USAA | $188 | $2,255 |

| Nationwide | $190 | $2,280 |

| GEICO | $239 | $2,871 |

| Progressive | $257 | $3,081 |

| Kemper | $260 | $3,124 |

| Travelers | $266 | $3,187 |

| Erie Insurance | $288 | $3,458 |

| American Family | $313 | $3,753 |

| Auto-Owners | $347 | $4,160 |

| Allstate | $369 | $4,424 |

| State Farm | $417 | $5,006 |

| Farmers | $422 | $5,066 |

Car Insurance Pricing

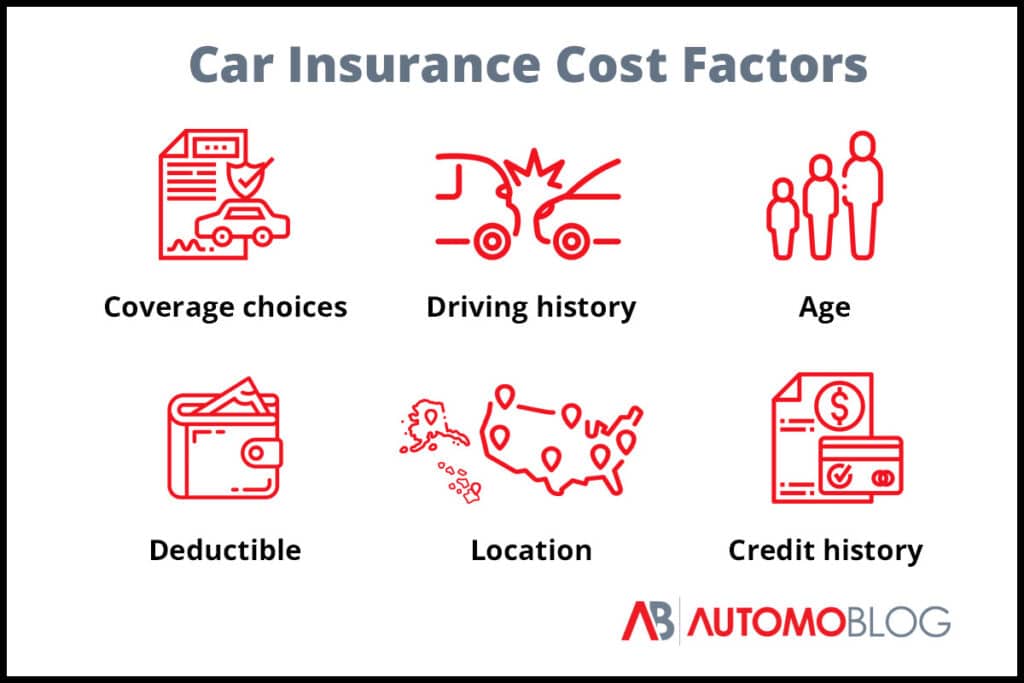

Auto insurance premiums vary significantly based on several factors. How much each factor impacts your final costs depends on the provider you choose, which is why it’s important to compare average car insurance rates from multiple providers.

Factors that Affect Car Insurance Rates

Here are the main factors that impact car insurance rates:

- Credit score: People with poor credit scores pay more for car insurance in most states.

- Deductible amount: The higher your auto insurance deductible, the lower your rates will likely be.

- Coverage limits: Car insurance premiums for full coverage are much higher than those for state-minimum coverage.

- Driving record: Drivers usually pay far higher prices if they have DUIs or speeding tickets or have been at fault for accidents.

- Bundling options: Those who bundle auto insurance with coverage such as renters or homeowners insurance may find lower rates.

- Age, listed gender, and marital status: Young drivers, singles, and motorists listed as male on their license typically pay higher rates than drivers in other categories.

- Location: Drivers usually receive higher insurance quotes if they live in states with extensive coverage requirements or areas with large numbers of thefts, accidents, and uninsured drivers.

- Vehicle make, model, and age: Older models may have more affordable replacement parts but lack newer safety features. Vehicles with poor safety ratings tend to have pricey coverage policies. While the Toyota Corolla and Ram 1500 are typically pricey to cover, the Honda CR-V and Ford Escape are two of the models with the cheapest car insurance rates.

- Discounts: Most providers offer car insurance discounts that can help you lower the cost of your auto coverage.

Car Insurance Coverage

Car insurance that offers more extensive protection than the state minimums for bodily injury liability and property damage liability coverage is more expensive. However, drivers are highly encouraged to add the following types of coverage to reduce costs and stress after an accident:

- Collision coverage

- Comprehensive coverage

- Uninsured motorist coverage

- Personal injury protection insurance (PIP) or medical payments coverage (MedPay)

Since car insurance companies calculate rates based on many variables, it’s difficult to determine your potential costs without comparing quotes from providers. Using online quote calculators can help you figure out how much you might spend.

Average Car Insurance Cost: Conclusion

Our in-depth industry research shows that the average full coverage car insurance policy costs $165 per month or $1,983 per year on average. However, your final car insurance costs will depend on various factors, such as the provider you choose, your deductible, location, age, and driving history.

The easiest way to find your average price for auto coverage is to compare car insurance quotes online. Doing so lets you consider each provider’s offerings to determine which policies best suit your needs.

Best Priced Car Insurance Companies

Many drivers find competitive rates from USAA, State Farm, and GEICO. All three car insurance providers are available across the country and offer quality auto insurance policies with relatively affordable rates.

USAA: Best for Military

Average car insurance cost: $1,179 per year

Better Business Bureau (BBB) rating: A+

AM Best financial strength rating: A++

Turn to USAA if you’re in the military, a veteran, or in the family of a service member. The company offers the lowest average cost of car insurance among all providers and is known for outstanding service. Motorists with DUIs may be better served by a different company though, as USAA only ranks average for costs with those drivers.

For more about the company, read our USAA auto insurance review.

State Farm: Best Customer Experience

Average car insurance cost: $1,872 per year

BBB rating: A

AM Best financial strength rating: A++

Drivers often turn to State Farm for relatively cost-effective car insurance policies that come with many discount opportunities. Our research shows that high-risk drivers with recent DUIs and accidents can find reasonable rates from State Farm. The company’s local presence makes it easy to build strong relationships with agents as well.

Check out our State Farm car insurance review for more details.

GEICO: Most Discount Options

Average car insurance cost: $1,779 per year

BBB rating: A+

AM Best financial strength rating: A++

GEICO is known for its affordable rates and impressive range of coverage. On top of those low rates, we found that the provider offers one of the widest selections of car insurance discounts in the industry. Many drivers in search of cheap coverage will find it at GEICO.

Read our full GEICO auto insurance review for more information.

Average Cost of Auto Insurance: FAQ

How much are car insurance rates on average?

The average rate for full-coverage car insurance is $1,983 per year among American drivers. This number varies based on age, driving record, location, chosen coverage amounts, and other factors.

How do I estimate the cost of car insurance?

The quickest way to estimate the cost of car insurance is by comparing car insurance quotes from providers. This way, you can look at your coverage options side by side to figure out which ones best suit your needs.

What state has the lowest auto insurance rates?

Vermont is the state with the lowest auto insurance rates on average, at around $978 per year. Other states with a low average cost of car insurance are Ohio, Maine, Idaho, and Virginia.

What is the cheapest auto insurance company?

The cheapest auto insurance company is often USAA, with average annual rates of around $1,179 per year. Other affordable coverage options typically come from Erie Insurance, Nationwide, GEICO, and Auto-Owners Insurance.

Is $200 a lot for car insurance?

Yes, $200 a month can be considered expensive for car insurance. Our research shows that the average 40-year-old driver with a good credit history and clean driving record pays an average of $165 per month for a full coverage policy.

How much does monthly car insurance cost?

Based on our research, the average rate for full coverage car insurance per month is $165. However, your own car insurance costs will vary based on your location, driving record, and credit history.

Is car insurance cheaper once you are 25?

Yes, rates continuously drop as you get older. Teen drivers and those who lack driving experience usually pay hundreds of dollars more for car insurance than experienced drivers. Keep in mind that if you have an accident on your record or a speeding ticket you may not see premium deductions for several years.

What is the average cost of car insurance?

Based on our data, most drivers pay an average of $165 per month or $1,983 per year for a full coverage car insurance policy. However, there are several factors that will affect the final price you pay for an insurance premium.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.