Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

The six standard types of car insurance are liability insurance, comprehensive coverage, collision insurance, uninsured motorist coverage, MedPay, and PIP.

Knowing the different types of auto insurance will not only help you save money on your car insurance policy, but it will also make you a better and more educated consumer. That’s because buying car insurance can turn into an expensive proposition, especially if you don’t know what you’re buying or getting for your money.

The trick is to choose the right type of coverage that is perfect for your needs and budget. And to do that, you need to know the best car insurance choices, including the significance and usefulness of each type of coverage.

Types of Car Insurance Coverage

There are six standard types of car insurance coverage. These are:

- Liability insurance

- Collision coverage

- Comprehensive insurance

- Uninsured motorist coverage

- Medical payments (MedPay) coverage

- Personal injury protection (PIP)

Some of these standard car insurance coverage options may be mandatory in your state, while others may be optional. However, even if a type of car insurance is not required where you live, it should still be available to purchase from your insurer.

The sections below will provide detailed information on the standard types of car insurance coverage you can buy.

Liability Coverage

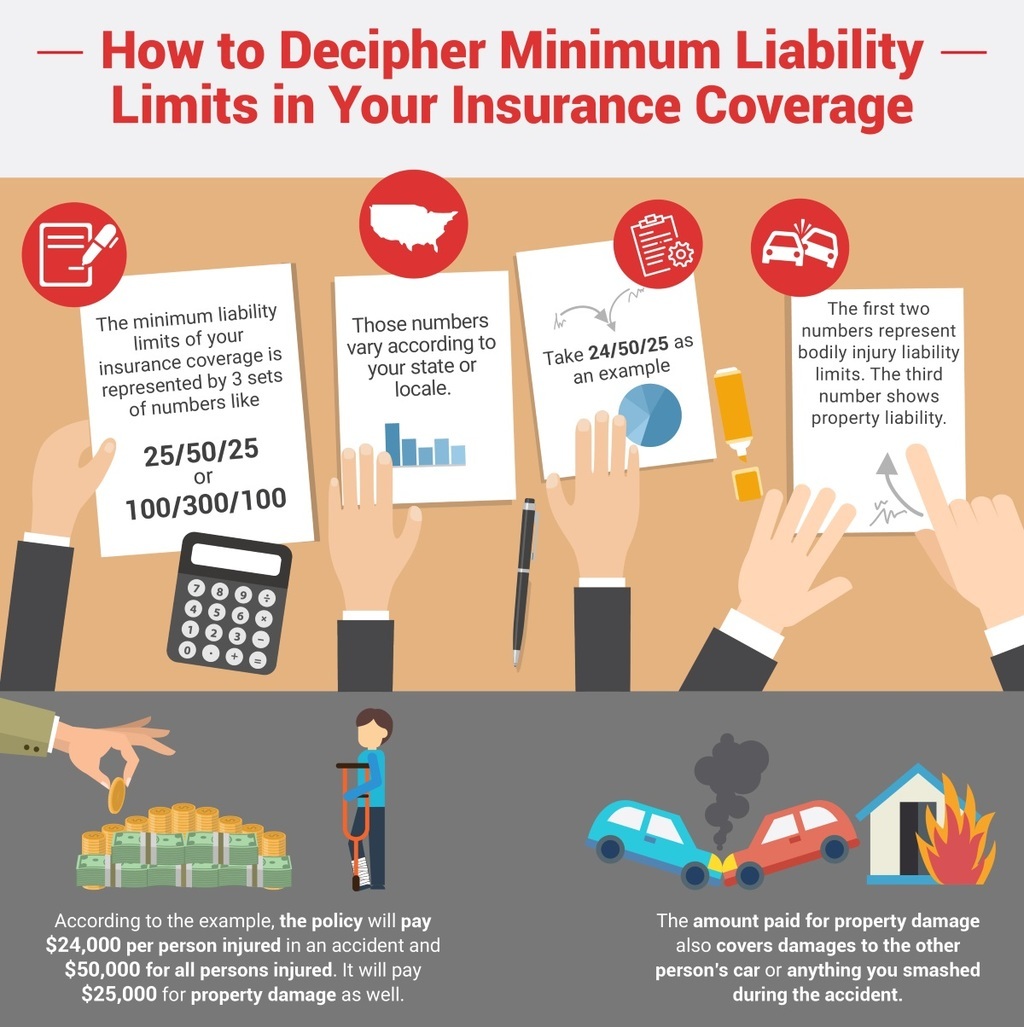

Every US state, except New Hampshire and Virginia, requires liability coverage or casualty insurance as the absolute minimum. That said, it is illegal in many US states to operate a motor vehicle without liability coverage.

Types of Liability Insurance

Liability car insurance coverage includes:

- Bodily injury liability (BI): This pays for other drivers’ injuries in accidents where you are at fault. It does not pay for your injuries.

- Property damage liability (PD): This covers damage to other vehicles or property in at-fault accidents.

Liability insurance will not cover vehicle repairs or damages to your car, and in most cases, the coverage is very low. That’s why it’s important to consider purchasing additional coverage for better protection.

To make things even more complicated, the laws vary state-by-state in terms of who pays for what based on who is at fault (which itself is often tricky to determine.)

Collision Coverage

If you cause an accident, liability insurance will pay for the medical costs and property damage of the other driver. But who will pay for the damages to your vehicle?

Collision insurance will take care of all the expenses to either fix or replace your vehicle after a crash. The coverage includes damages after crashing into an object, crashing into another car, or if your car spins, rolls, or flips on the road.

In most US states, collision coverage is not a major requirement. But if you want to protect yourself from a huge financial loss after an unforeseen accident, having both liability and collision coverage will give you added peace of mind.

Comprehensive Coverage

Comprehensive coverage is also called ‘Acts of God’ insurance because it covers vehicle damage that is not caused by a car accident. This type of coverage is designed to protect you and your wallet from significant repair bills caused by non-accident-related claims.

Comprehensive coverage will protect your vehicle from:

- Theft

- Vandalism

- Fire

- Falling objects

- Natural disasters such as earthquakes, floods, etc.

- Accidents caused by animals such as cows, deer, moose, bears, and even birds (whether you were hit by the animal or you accidentally hit them)

- Glass breakage

- Wind storm

- Riots and/or civil disturbances

Do I Need Comprehensive Insurance?

You will need comprehensive coverage if you are:

- Leasing a car that requires a ‘full coverage’ policy

- Currently paying a brand new vehicle that requires ‘Full Coverage’ insurance

- Looking to protect your car from damages that are not covered by collision coverage

Personal Injury Protection (PIP)

Personal injury protection insurance (PIP) will cover all your medical expenses in the event of an accident, no matter who is at fault. This is the reason why PIP is popularly called ‘no-fault insurance’.

Personal Injury Protection States

PIP is commonly the required insurance coverage on no-fault states such as Florida, Michigan, New Jersey, New York, Pennsylvania, and Puerto Rico. Keep in mind that the aforementioned states have verbal thresholds for PIP, which means that there is a certain threshold based on the insured party’s degree of injury (such as whole or partial loss of a body member) that must be exceeded before a lawsuit can be filed against the negligent party.

Other no-fault states include Kansas, Hawaii, Massachusetts, Kentucky, Minnesota, North Dakota, and Utah. These states have a monetary threshold for PIP, which means that there is a certain threshold based on the insured party’s degree of injury (which is measured in dollars based on the medical costs incurred) before a lawsuit can be filed against the negligent party.

Depending on the policy, PIP may also cover child care, lost income claims, and funeral expenses.

Medical Payments Coverage (MedPay)

Most people think about coverage for vehicle damage when purchasing auto insurance. But your health and well-being is far more important than the damages to your vehicle.

Auto medical payments, or Med-Pay, will cover your medical expenses, including your passengers and other household members involved in the crash.

Med-Pay will also pay for:

- Injuries that you sustain as a pedestrian, or if you’re riding a bicycle and you get hit by a vehicle.

- Dental bills that came as a result of a vehicle accident.

- Funeral expenses.

Med-Pay insurance will also cover insurance deductibles and copays of other insurance policies, including PIP.

If your health insurance provides coverage against car accidents, there is no reason why you should purchase additional coverage like Med-Pay. Look into your medical policy before deciding if you should add Auto Medical Payments to your auto policy.

Uninsured Motorist Coverage

Uninsured or underinsured motorist insurance will protect you and your car from road accidents caused by other motorists who don’t have auto insurance (uninsured).

This is also used to cover your medical and car repair bills from offending drivers who don’t have sufficient insurance coverage (underinsured). This type of auto insurance is required in about half of all US states.

Uninsured Motorist Bodily Injury

Uninsured motorist coverage or uninsured motorist bodily injury (UMBI) will pay for the medical expenses, pain and suffering, and lost wages of you and your passengers. The policy will also cover your medical costs if you and your passengers were victims of a hit-and-run incident. Uninsured motorist coverage may also cover property damage, such as your house, fence, and personal items like your laptop and smartphone.

Underinsured Motorist Bodily Injury

Underinsured motorist bodily injury (UIMBI) insurance will cover your medical payments when the offending party’s insurance is not enough to cover all your medical bills. However, if your under-insured policy limit is lower than the bodily injury liability coverage of the offending driver, then you will not receive any benefits.

Different Types of Car Insurance Coverage

Other types of car insurance coverage exist, though they are not as common as the ones listed above. A few additional coverage options include:

- Rental reimbursement

- Emergency roadside assistance

- Guaranteed asset protection (GAP)

- Mechanical breakdown insurance (MBI)

Rental Car Reimbursement

Rental reimbursement policies will cover the cost of your rental car while your vehicle is being repaired after an accident. Certain policies like collision and comprehensive insurance will usually come with rental reimbursement.

This type of auto insurance coverage is not usually required. But if you don’t have a secondary vehicle and you need to either go to school or work while your car is being repaired, it is good to have rental reimbursement as part of your car insurance policy.

Keep in mind that there is a per-day or per-accident limit on rental reimbursement coverage. For example, if the per-day limit is $35 and has an $800 per accident maximum, the coverage will only pay for the first $35 per day (so don’t get such an expensive rental car), and it will stop once your rental expenses have exceeded the $800 limit.

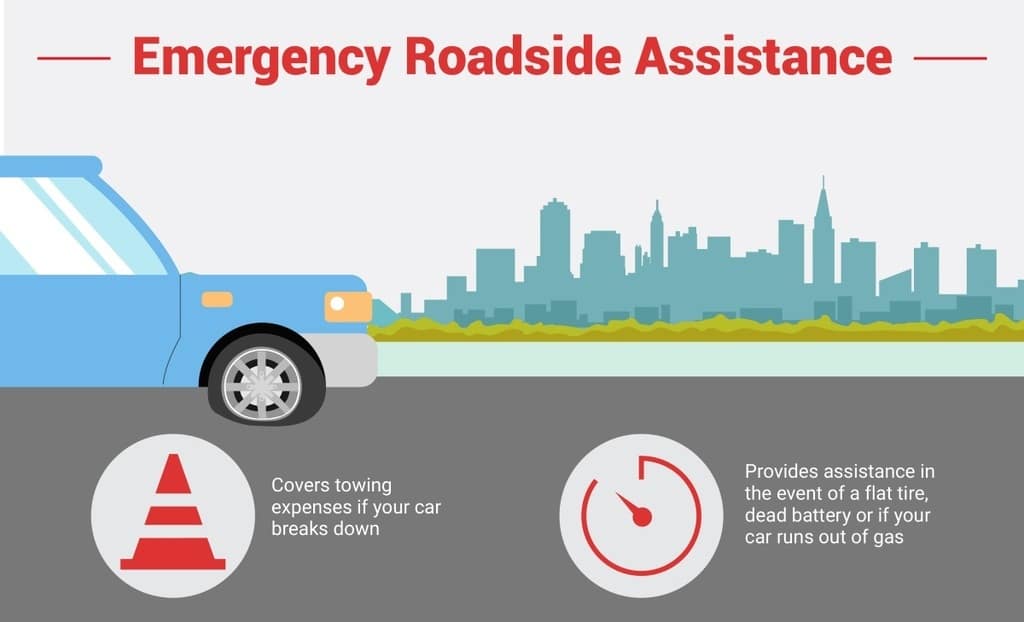

Emergency Roadside Assistance

Emergency roadside assistance will assist you in the event of:

- Flat tire or blown-out tire

- Dead battery

- Engine failure

- If your car runs out of fuel

- You left your keys inside your vehicle

- Your vehicle is stuck in mud or snow

Emergency roadside coverage will cover the cost of towing, changing the tire, fuel delivery, battery service, and locksmith services.In addition to some auto insurance companies offering this roadside assistance and even some car manufacturers offering it to new car buyers, there are many companies that offer emergency roadside assistance, with AAA being the most popular in the United States.

GAP Coverage

GAP insurance will pay for the cost of depreciation if you happen to wreck or total your vehicle after a crash.

For example: If you bought a new car for $20,000 and totaled it after 6 months, the insurance company will pay you around $17,000 after depreciation is considered. GAP insurance will cover the additional $3,000 lost due to depreciation.

If you happen to be involved in an accident while you are still paying for your car via an auto loan, GAP insurance will prevent you from continuously paying money on a car that was totaled, wrecked, or no longer fit for daily use.

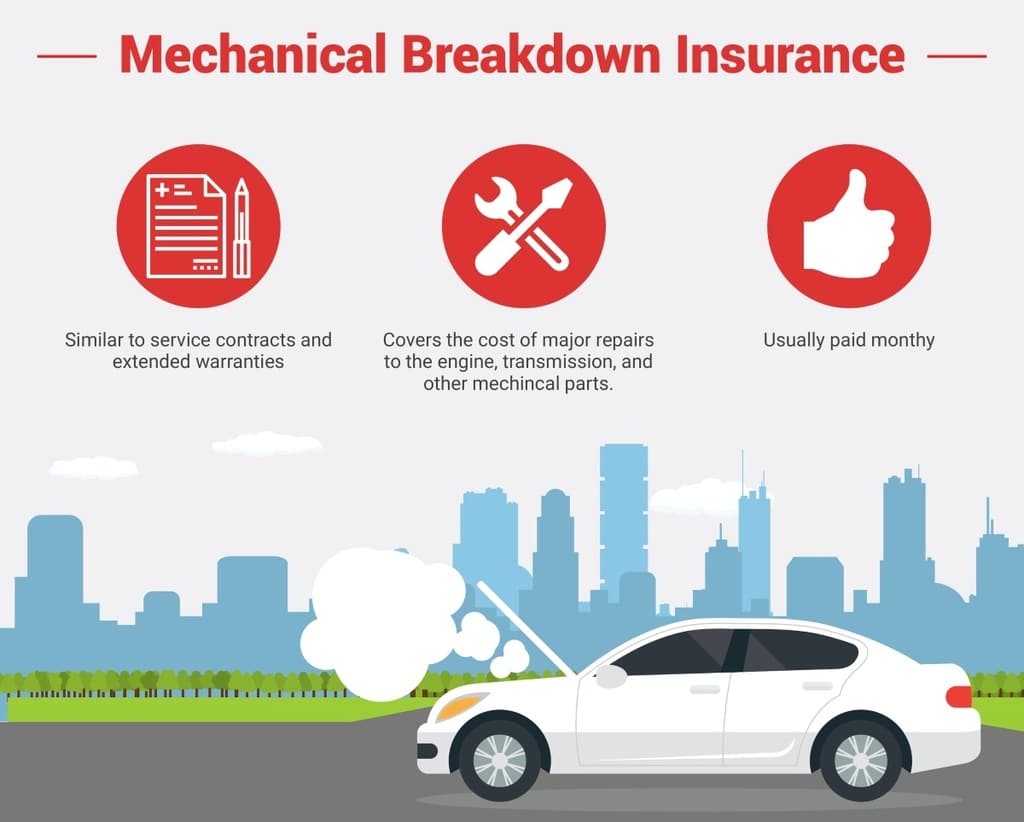

Mechanical Breakdown Insurance (MBI)

Mechanical breakdown insurance is usually better than paying for extended warranties because you pay small monthly premiums instead of a lump sum amount.

This type of insurance coverage will pay for major repairs to the engine, transmission, and other mechanical parts.

Mechanical breakdown insurance is usually available for new or leased vehicles that are less than 15 months old, or those with less than 15,000 miles on the odometer.

Types of Car Insurance: Conclusion

This article looked at the standard types of car insurance coverage offered by providers. The minimum coverage you are required to purchase depends on where you live. Most states only require liability car insurance, but it can be worth exploring other options by shopping for car insurance coverage.

Car Insurance Recommendations

There are several companies that offer affordable insurance with solid coverage, including State Farm and GEICO. The best way to find out how much you’ll pay for insurance is by comparing car insurance quotes from providers.

State Farm: Best Customer Experience

We chose State Farm as Best Customer Experience for 2023 because of its high service standards and quality coverage. One of the biggest advantages of having State Farm insurance is its wide range of local insurance agents. Drivers can purchase all major types of car insurance coverage through State Farm. The provider has a solid reputation in the insurance industry with an A++ financial strength rating from AM Best and above-average scores in the J.D. Power 2022 U.S. Auto Insurance StudySM.

Keep reading: State Farm insurance reviews

GEICO: Most Discount Options

GEICO is not only one of the most affordable providers but also the most accessible. It offers all the major types of car insurance in addition to unique offerings like mechanical breakdown insurance (MBI). In addition, drivers can find peace of mind in the provider’s financial stability and ability to pay out claims with an A++ financial strength rating from AM Best.

GEICO also scored above average across most regions in the J.D. Power U.S. Auto Insurance Study and in the J.D. Power 2022 U.S. Auto Claims Satisfaction Study.

Keep reading: GEICO insurance reviews

Types of Car Insurance Policy: FAQ

Below are frequently asked questions about the different types of car insurance policies.

What are the three types of car insurance?

The three main types of car insurance coverage are liability, comprehensive, and collision car insurance. These combine to form a type of policy known as full coverage.

What is full coverage insurance?

Auto insurance providers will typically offer collision coverage and comprehensive coverage in a single policy called ‘Full Coverage.’ It is meant to provide a complete level of protection against an accident, such as combining liability insurance, collision coverage, and comprehensive coverage.

What are the seven types of car insurance?

The seven types of car insurance are as follows: liability insurance, comprehensive insurance, collision insurance, full coverage, uninsured motorist coverage, medical payments coverage, and PIP insurance.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.