As Featured On

Must-Read Guides

Find the right product for your vehicle and your wallet.

Auto Warranty Guides

Our research team spends hundreds of hours per year reviewing the top auto warranty companies. Read below for custom content, videos, and analysis to make the right decision for your ride.

Hot News 🔥

Features

The average cost of a 30-second Super Bowl commercial in 2024 is...

We unpack Concord Auto Protect extended warranty coverage, cost, benefits, and claims process so you can determine whether it’s the right fit for you.

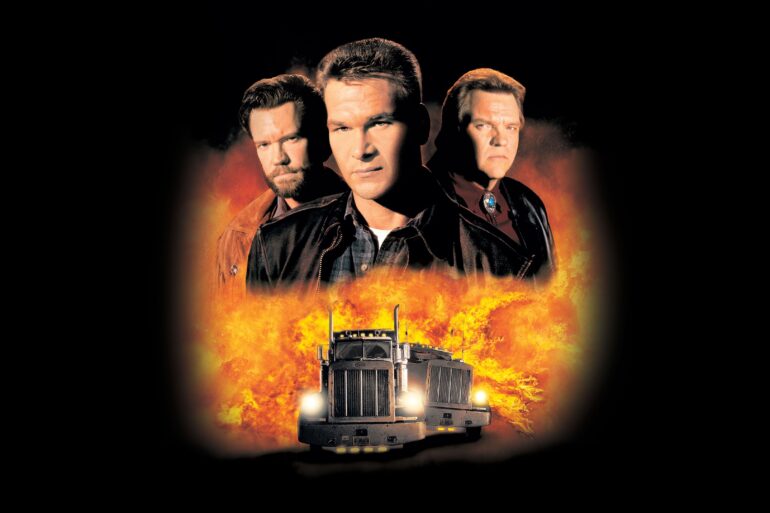

Veteran trucker Jack Crews (Patrick Swayze) reluctantly agrees to haul a shipment “off the books” but discovers a trailer full of illegal weapons as both federal agents and gangsters close in.

“Any technician knows there are highs, and there are lows; every technician...

Our Latest Videos

Keep Reading...